Cementing a promising outlook

Ambuja Cements Ltd (Ambuja) is a leading cement company in India. Ambuja is a part of the Adani Group, the largest and fastest-growing portfolio of diversified sustainable businesses.

Key Highlights

Consolidated revenue from operations increased 11.2% YoY to Rs. 9,889cr, with cement segment growing 10.5% YoY in Q4FY25.

The revenue growth is attributed to the effective implementation of micro-market management strategies, expansion of ground network, consistent high-blended cement levels at 82% and a notable rise in premium products to 29.1% of overall trade sales.

Operating expenses for Q4FY25 reached Rs. 4,104 per ton, fuelled by efficient energy management and a heightened emphasis on renewable sources.

Transportation costs decreased 2% to Rs. 1,238 per ton due to optimized logistics and a closer-to-market approach.

EBITDA rose 9.9% YoY to Rs. 1,868cr, while EBITDA margin fell to 18.9%, down 20bps YoY.

Consolidated reported PAT plummeted 15.7% YoY to Rs. 1,282cr in Q4FY25 from Rs. 1,521cr in Q4FY24.

OUTLOOK & VALUATION

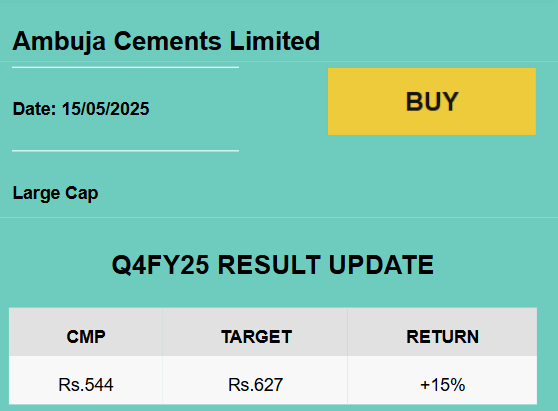

Ambuja Cements put up a robust financial performance and crossed 100 million tons of cement capacity, becoming the 9th-largest cement company globally. With a strategic focus on growth, operational excellence, increasing market presence, strengthening ground network, improving efficiency and cost leadership, Ambuja is well-positioned to maintain its market leadership and achieve sustainable performance. The company’s growth will be further supported by a strong leadership team which will be instrumental in achieving organizational goals. Therefore, we upgrade our rating on the stock to BUY with a revised target price of Rs. 627 using a target multiple of 14.5x FY27E EV/EBITDA.