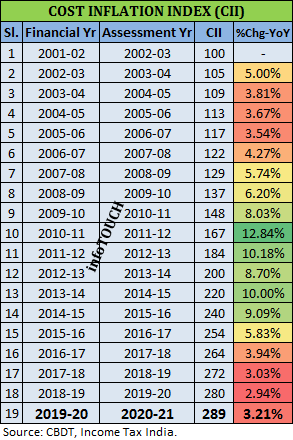

What is Cost Inflation Index? Cost Inflation Index, also referred to as CII, is an index maintained and notified by the Central Board of Direct Taxes, on an annual basis, according to Section 48 of the Income-tax Act. It essentially measures the relative inflation that prevailed between two given financial years.

What is Cost Inflation Index? Cost Inflation Index, also referred to as CII, is an index maintained and notified by the Central Board of Direct Taxes, on an annual basis, according to Section 48 of the Income-tax Act. It essentially measures the relative inflation that prevailed between two given financial years.

How CII is computed? According to the explanation given in Section 48 of IT act, CII of a financial year is notified by the central government, having regard to 75% of the average rise in CPI (Urban) index during the immediately preceding year. The comparison index is changed to CPI (Urban) since 1-4-2016.

Base Year shift: Base year is the year from when the CII series is being published with the base value as 100. Earlier the base year for CII used to be 1981-82. Budget 2017, proposed to amend the Base Year of CII from 1981-82 to 2001-02. The reason for base year change is mainly due to the difficulties and problems tax payers used to face for valuing the properties bought before the 80s. It was equally difficult for the tax authorities to go by such reported valuations. Henceforth, for capital assets (properties) bought before 2001, assesses can use the ‘Fair Market Value (FMV) as of April 2001’ or the ‘Actual cost of purchase’, whichever is higher.

CII and its applications: CII is primarily used to compute the inflation effect on the gains during the sale of certain specified assets and investments such as property, debt mutual funds, gold, unlisted shares, etc.

Gains arising out of sale of capital assets are called capital gains. Capital Gains can be of two types – Short-term and Long-term- depending on the asset type and the holding period. There are stipulated holding periods for different assets for the gains to qualify as ‘long-term’. In the case of property, gains arising from sale after five years (since April17) qualify as long-term capital gains. In the case of debt and non-equity mutual funds, gold, etc. gains arising from sale after three years, qualify as long-term.

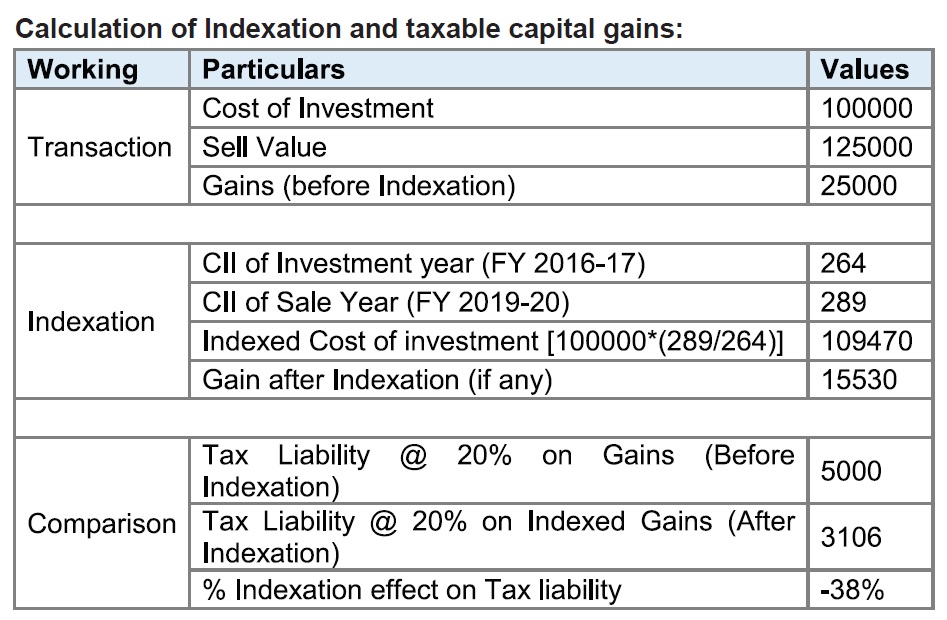

What is Indexation? Indexation is the process of improving ‘Original cost of acquisition’ of a capital asset, with that of inflation as measured by CII that prevailed during the holding period while calculating the capital gains. Since gains are the difference between sale value and the purchase cost, an improved cost of acquisition (as per CII) would likely result in lesser gains, and hence lesser tax outgo. Indexation benefit helps in ascertaining the capital gains after adjusting for inflation, to reflect a more realistic economic result.

How to calculate the Indexed cost of Acquisition / Purchase?

Indexed Cost of Acquisition / Purchase = Original Cost of Acquisition X [CII during the year of sale / CII during the year of purchase or 2001-02, whichever is later]

Effective Use of CII in Mutual Funds with Indexation Benefits: (Non-Equity Oriented Schemes like Debt Funds, FMPs, Gold Funds, etc.)

Let’s assume, that an Individual has invested Rs.1,00,000 on 01.04.2016, in a Debt Fund that is eligible for Indexation. She redeemed the investments on 01.05.19 at Rs.1,25,000. Gains: Rs.25000. They are Long Term, since the investment is held for more than 36 months.

This is where Debt mutual funds scores over other investment options that are without Indexation benefits (like FDs), where taxation is on the whole gains and as per the individual’s marginal tax slab.

Alternatively, without indexation, the tax would be charged on the Total Gains i.e., Rs.25,000 and at the Individual’s respective Tax Slabs. Which means an assesse in 30% Tax bracket would have a tax liability of around Rs.7500, 20% Tax Slab around Rs.5,000 (plus cess and other costs). With Indexation, the tax liability dropped by -38% for those in 20% tax bracket and by -59% for those in 30% tax bracket.

It must be noted that in the last two financial years, CII has highly moderated due to a drop in the average CPI inflation. Still debt mutual fund investors were able to reduce on the tax out go, by availing the Indexation benefits. During high inflation years, the tax advantages could be more (as CII would be higher), sometimes resulting in nil tax (like FY’10 to FY’15).

Debt Mutual Funds has a good potential to maximise the post-tax net yield and returns by way of indexation benefits, and hence lesser tax outgo.

Key points to keep in mind while investing in a debt scheme:

Debt MF offers advantages over other traditional fixed income products, but they also come with Market, Interest rate, Liquidity and Credit risks. As explained by us earlier on different occasions, primary factors one should consider while looking at debt funds are, the credit quality of the portfolio – how much of the instruments are rated AAA / Sovereign and below, the average maturity and the modified duration – which basically indicates the degree of fluctuations in case of interest rate changes, the concentration level in the portfolio – how much % weight the top holdings / sectors carry, single group or company exposure, the scheme’s and the fund manager’s track record, the risk management processes adopted by the fund house could be checked upon.

Year – wise Cost Inflation Index values for reference: