After gaining an average of 14% this week and more than 30% in the last one month, railway stocks may now come under some profit booking pressure.

India stands as the world’s fifth-largest economy, with its economic landscape chiefly shaped by the services sector, which accounts for over 50% of the total GDP. The sustained growth is primarily driven by domestic demand, propelled by the emerging middle class. Industry, on the other hand, constitutes less than one-third of the GDP, with manufacturing contributing to 50% of the industry’s Gross Value Added (GVA) in FY23.

India presently accounts for a mere 3% of the global manufacturing output. Historically, India has not been strongly oriented towards manufacturing as a core economic focus. However, the long-term policy is changing, giving equal importance to domestic industries. The government is revamping the industry’s norms and regulations with a vision of self-sufficiency and to become the manufacturing hub for the world.

To attain this goal, the initial phase involves enhancing both the quantity and quality of fundamental infrastructure assets through an increased allocation of government funds. Frankly, the government’s fiscal position had become robust, led by financial reforms increasing the corpus size.

Over the past five years, government capital expenditure has seen a remarkable 23% CAGR, reaching to ₹7.3 trillion, accounting for 2.7% of GDP. In the first quarter of FY24, the government has already utilized ₹2.8 trillion, which constitutes 27.8% of the allocated annual capital expenditure for FY24. Two-thirds of the Center’s capital expenditure in Q1FY24 was incurred on the construction of roads and railway infrastructure.

The government’s unwavering commitment to infrastructure development through initiatives like NIP, GATI Shakti, and budget allocations has resulted in a robust order book, a promising project pipeline, improved profitability, and enhanced return ratios, providing a significant boost to the infrastructure sector.

The alternative strategy is to stimulate the industrial sector by offering financial incentives for capital expenditure and other financial aids, such as reducing effective taxes. In 2019, the basic corporate tax rate was slashed from 30% to 22% (excluding surcharges and cess), thereby enhancing cash flows and potentially boosting future private expenditure. Thirdly, is to support the MSME being the backbone of the domestic industry sector; credit and guarantee to MSME have been substantially increased with the introduction of the Emergency Credit Linked Guarantee Scheme (ECLGS).

To incentivize large-scale manufacturing, PLI scheme has been launched across 14 sectors, backed by an allocation of ₹1.97 lakh crore, and more categories are expected to join. The government is providing 50% financial support for capex and 2.5% for R&D. Swift measures are underway to address the needs of the semiconductor, laptop, and green hydrogen sectors.

The government’s Make-in-India initiative is actively promoting investment, fostering innovation, and developing top-tier infrastructure. For example, in the mobile phone segment, India has become the second-largest mobile phone manufacturer globally, with the production of handsets going up from 6 crore units in FY15 to 29 crore units in FY21. This trend is instrumental in bridging the gaps in domestic manufacturing capabilities, driven by a surge in FDI. Annual FDI equity inflows in the manufacturing sector have been steadily increasing over the last few years. It jumped from US$ 12.1 billion in FY21 to US$ 21.3 billion in FY22.

India has a unique opportunity to become a global manufacturing hub. The PLI scheme is estimated to generate ₹3 lakh cr of capex and 60 lakh jobs in the next 5years. This development not only enhances in-house manufacturing capabilities but also curtails the import bill, fortifying the country’s fiscal strength. Electronic exports increased from USD 3.9 bn in FY18 to USD 13.8 bn in FY23 (economic survey). And the electronics industry is likely to be a key driver of manufacturing in the future.

The slowdown of the Chinese economy may have hiccups in some parts of the world. And we are well positioned to take advantage as global market is essentially considering India as the next growth engine. The domestic total electronics industry, as of FY20, is valued at US$118 billion. Government expects it to reach US$300 billion with US$ 120 billion of exports in FY26.

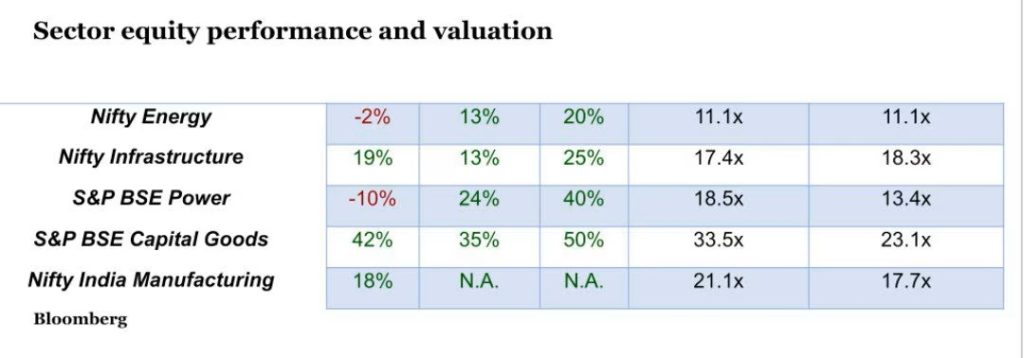

So much is happening in the industrial sector. High infra & capital expenditures are enhancing the aura of infra, power, manufacturing, and industry sector. The equity performance of these sectors has been rolling for the last 3years. These are expected to continue as the real benefit will be exposed in the next 5 to 10years. As foreign, private, and public expenditure continues to invest the industry outlook will remain robust. This leads to strong equity market performance and premium valuation.

Specifically, sectors like capital goods and power are currently rated well above their long-term averages, while others, such as energy and infrastructure, maintain a more balanced position. Given that manufacturing is a central theme for the future, it is reasonable to anticipate that premium valuations will remain a lasting feature of these sectors.

First published in Mint