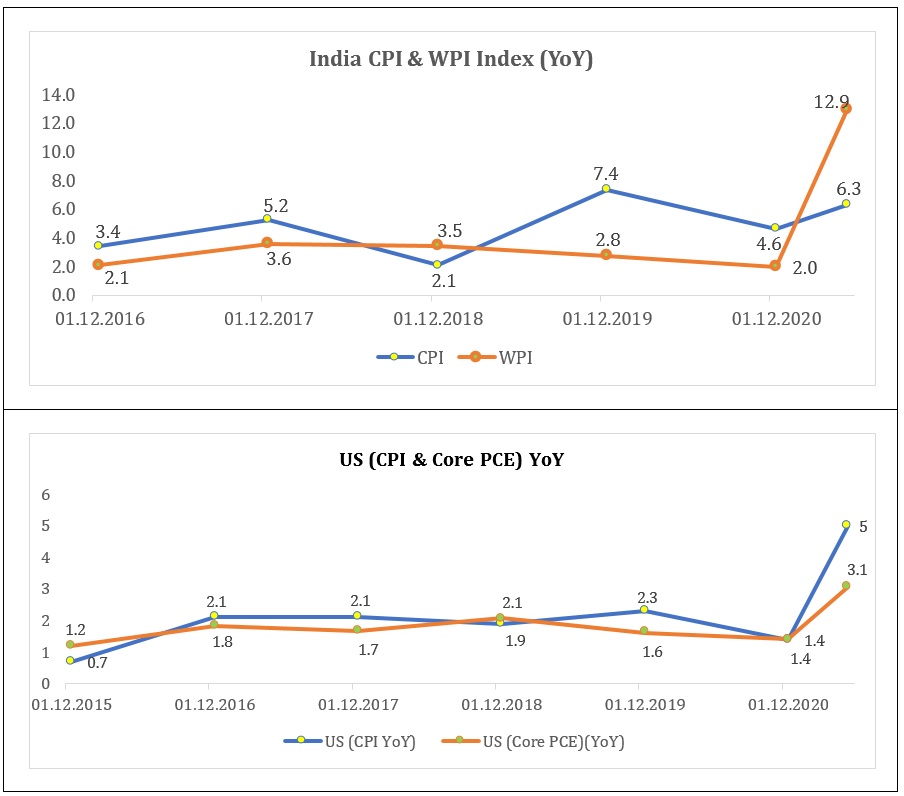

Global and domestic inflation rates are rising. Indian CPI inflation rate has risen to 6.3%, much above the RBI’s comfort level. This is unlikely to change the low interest policy of RBI in the near term in anticipation of relaxation in prices due to unlocking. Globally, importantly in the US, CPI inflation has increased to 5%. Core inflation which is the key policy data of FED, has increased much above the long-term forecast of 2% to 3.8%, and it is forecasted to increase to 4.3% by next month. Till date, it has not brought about any change in monetary policy. And it is unlikely to bring a deep change in the stance of low interest policy. The ongoing high inflation is presumed to be short to medium-term in nature. Rather than reflation, the normalization of the economy to a post-pandemic period can bring about a change in easy money policy of tempering the level of liquidity in the financial system. This can have a negative effect on future equity assets and their performance ahead. We have to adjust our equity investments/strategy, to make it overcome this likely change in equity investment scenario.

Key learnings of inflation to equity market:

Equity likes inflation, but of a decent level: Equity market or companies are tolerant to inflation to a good extent. Many a time, inflation is caused by demand. Higher the demand the better it will be for companies, industries and economy by increasing the value addition and profitability. Inflation is also caused by shortage of supply, which too increases profitability and reduces the requirement of working capital. Equity market loves higher prices as higher the growth (originated by inflation/demand) better is the performance of the equity class.

Hyper inflation is disadvantageous for equity: Very high inflation can provide overall growth in equity assets but will be lower than growth in inflation. This reduces the level of value addition due to risk of high inflation. Equity can under perform compared to inflation due to fall in demand, rise in cost and interest rate impacting profitability. In such scenario, the best performing assets can be gold and commodities.

Disinflation is highly detrimental to economy: This leads to overall loss to the company, industry and economy, like operational and industry structure, leading to sharp loss in value addition and valuations. Here the best performing assets will be high quality debt papers due to likely falling interest rates and rising economic risks. Equity performance can be mixed with quality stocks doing well and outperforming the market, especially under the accommodative monetary policy.

Currently, we are at short-term high inflation

Currently, we are in a situation of high short-term inflation due to shortage of supply prompted by the pandemic, low base and rising prices supported by liquidity. Also referred to as Reflation, through accommodative monetary and fiscal measures. Inflation is expected to reduce during the medium to long-term, as the economy further opens, both globally and domestically. For India, high fuel and agriculture prices, can maintain their stickiness unless the government intervenes with policy support and changes, can be detrimental. Globally, inflation can reduce to moderate levels, during the year, as commodities prices reduce and availability of labor and supply chains improve. So, rising inflation is unlikely to surge as the key determinant for the equity market in the long-term.

Not inflation but normalization of the economy will be unfavorable for equity

Short-term inflation can lead to a slowdown in monetary policy which can impact the equity market only in the short-term. Whereas in the medium to long-term basis, the key issues are normalization of the economy, leading to a change in monetary and fiscal policies and fall in liquidity.

A key benefit for the equity market has been the easy money policy, both globally and domestically. Two monetary measures which helped the market are – the low interest rate policy and bond buying plans. Low interest cycle is expected to be maintained. But in the US, a strong economy moving towards a normal growth rate is likely to lead to a tapering of bond buying plan. This will reduce the level of liquidity and increase the cost of short-term yields. As a result, the pricing or valuations of equity will come down despite improvements in the economy.

Equities can undergo a stage of stagnation going ahead this year

It is plausible that global bond yields can rise, during the year, because of likely tapering of FED’s bond buying plan, early next year. This will make the US Dollar more attractive compared to risky emerging markets. INR is expected to depreciate. This can lead to a short to medium term consolidation in the equity market, especially for emerging markets. The overall environment for equity market is still lucrative given low interest rate and vigorous economic regime. But in the short-term, it is advisable to turn cautious and take profits especially of stocks and sectors sensitive to interest rates and FII inflows. Increase cash in your portfolio and sell at rise will be a good strategy. Develop a balanced portfolio of Equity, Bond, Gold and Cash.

Equity can still give returns, adjust your strategy

Become stock and sector specific to maintain the holistic view of equity asset. Stick with companies with stable cash flows, avoid high debt/equity ratio companies, buy and hold stocks of industries with promising outlook (IT, Pharma, Exports, Manufacture). Extra gains can be expected on turnaround companies, those undergoing transformation from heavy balances sheet to lean capital and operation (high margin) structure. During this transitory period of tapering, stocks and sectors highly oriented to US dollar income will outperform like IT, pharma and exporters. Defensive and value buying will do well, like FMCG, Consumption and Telecom. In growth sectors like Infra, Banks, Capital goods, Auto and Metals, performance will be muted due to likely rise in interest rate, in the near term. They should be bought on dips and investors have to be stock specific. We could undergo a phase of consolidation, sell in rally, during the year; dips can be used as an opportunity to buy. A big correction is unlikely due to the maintenance of a low interest rate policy for the next one or two years.