2018 was a volatile year for stock markets with sub-par returns. Even though India was an out-performer with positive returns for Sensex and Nifty, the returns for the broader market were poor with 8 out of 10 stocks posting negative returns and 6 out of 10 stocks declining by more than 25 percent. The deep cuts in mid-and small-cap stocks impacted the portfolio of retail investors who normally have a high weightage of mid and small-caps in their portfolios. Viewed from a one-year perspective, the returns from mutual funds were also disappointing.

2018 was a volatile year for stock markets with sub-par returns. Even though India was an out-performer with positive returns for Sensex and Nifty, the returns for the broader market were poor with 8 out of 10 stocks posting negative returns and 6 out of 10 stocks declining by more than 25 percent. The deep cuts in mid-and small-cap stocks impacted the portfolio of retail investors who normally have a high weightage of mid and small-caps in their portfolios. Viewed from a one-year perspective, the returns from mutual funds were also disappointing.

Sub-par returns for a year or two is par for the course in stock markets. Investors should look at returns over a longer period of time. The turnaround for the broader market appears imminent. After the disappointing 2018, year 2019 looks promising.

In 2018 the market was impacted by very strong headwinds. Corporate earnings disappointed for the fourth year in a row. The huge losses of the PSU banks (Rs 82000 crores for FY2018) severely impacted earnings. Macros deteriorated with sustained FPI outflows and sharp spike in crude. With Brent crude touching $86.7 to a barrel in October, trade deficit widened. CAD, which was steady at 0.7 percent in FY 2017, widened to an alarming 2.7 percent in H1 FY2019. Consequently INR depreciated sharply. The currency depreciation was aggravated by the sustained FPI outflows in 2018. The hawkish Fed stance and 4 rate hikes pushed the US 10-year yield to 3.26 percent by October 2018 negatively impacting investor sentiments in EMs. The tussle between the RBI and the government, the state election outcomes and the trade war between US and China also weighed on market sentiments.

Headwinds getting weaker; tailwinds getting stronger

India’s macros have turned for the better with the crash in crude, sharp decline in CPI inflation and fall in US bond yields. Crude price, which has rebounded from the lows of around $50 to around $60 presently is an area of concern; but so long as the price remain within $70, which is the likely scenario in the context of the global economic slowdown, India’s macros will not be impacted.

The global economy is expected to slowdown in 2019. If the current expansion in US goes beyond June 2019, it would be the longest period of expansion in US history. This goldilocks scenario is unlikely to continue for long. China is decelerating fast and growth in Europe is also likely to moderate. Though global growth slowdown is a headwind, this is a tailwind from the market perspective since central banks will turn dovish and monetary policy will become accommodative. The decline in US 10-year bond yield to 2.7 presently, from the peak of 3.26 percent in October, is good news for EMs since FPI inflows into EMs will accelerate. This, along with the strong and sticky domestic flows, can prove to be a strong tailwind for markets in 2019.

Interest rates will come down

An inevitable in 2019 would be interest rates heading south. CPI inflation in December has come in at 2.13 percent. With Repo at 6.5 percent, the real interest rate in India is way too high, perhaps the highest among the large economies of the world. This high real interest rate leaves a lot of room for rate cuts in 2019. The RBI is likely to shift its stance from calibrated tightening to neutral as early as in the February policy meet and thereafter moving to accommodative policy stance with a rate cut in April policy. This augurs well for the market.

Concerns from a populist budget

The 2019 interim budget, the last to be presented by the present Modi government, is likely to be a political document with an eye on elections. Big Bang schemes like a Targeted Basic Income Scheme, sops for the farmers in crisis, IT relief for the middle class and similar other measures are the likely budget initiatives. “Politics is the art of the possible”, therefore such measures are par for the course, even desirable, so long as they don’t strain the fisc beyond a point. The market will digest fiscal expansion in an election year. But if populism and profligate spending strains the fisc beyond safe limits, the market will react with undesirable consequences. Therefore, ideally, the FM should strive for a popular, not an unduly populist budget.

Election verdicts: Markets can get it wrong

The mega event of 2019 will certainly be the general election. Markets are known to react hyper-sensitively to election outcomes, particularly when the outcomes are at variance with market expectations. In recent times this happened in 2004 and 2009. In 2004 when the Vajpayee led NDA unexpectedly lost, the market crashed immediately, but smartly recovered when the reform-oriented Manmohan Singh government assumed charge with market-friendly P Chidambaram as the Finance Minister. Again in 2009, when the UPA won without the support of the left, the market gave a thumps up to the “game changing election outcome.” But, in retrospect, it would be right to say that the market was wrong in its assessment since the UPA 2 government, which was expected to usher in reforms, got embroiled in a series of scams and policy paralysis. In brief, the market can be wrong in its short-term assessment and knee-jerk reaction.

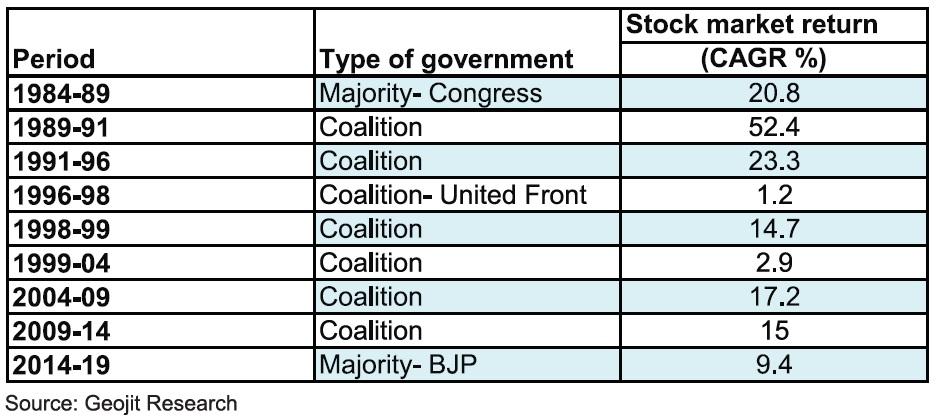

Coalitions have delivered superior returns

A popular misconception in markets is that single party rules are better than coalitions. In fact the reverse is true. From 1947 to 1977 India had single party rule led by the congress. But the economy fared poorly during this period with a measly growth rate of 3.5 percent. Poor growth and oppressive tax rates ensured low levels of corporate profitability. In the 1950s, 60s and 70s returns from the stock market couldn’t beat inflation rates. Hence real stock market returns were negative. In the 1980s, with economic growth picking up, stock market returns started beating inflation rates, delivering positive real returns. The real break through in economic growth, corporate earnings and stock market returns happened post 1991 when India entered the coalition era. Coalitions delivered superior GDP growth, earnings growth and stock market returns. The following data, detailing the stock market returns under various governments, is revealing.

It is important to note that in the long run, economic growth and corporate earnings drive the markets. Government’s economic policy and reform initiatives are important; but equally important, sometimes more so, is the external economic environment. During a benign external economic environment, even a lackluster government can deliver superior returns. The UPA 1 government is a case in point. Indian economy and markets benefitted from the global economic boom of 2004-08 even in the absence of worthwhile economic reforms.

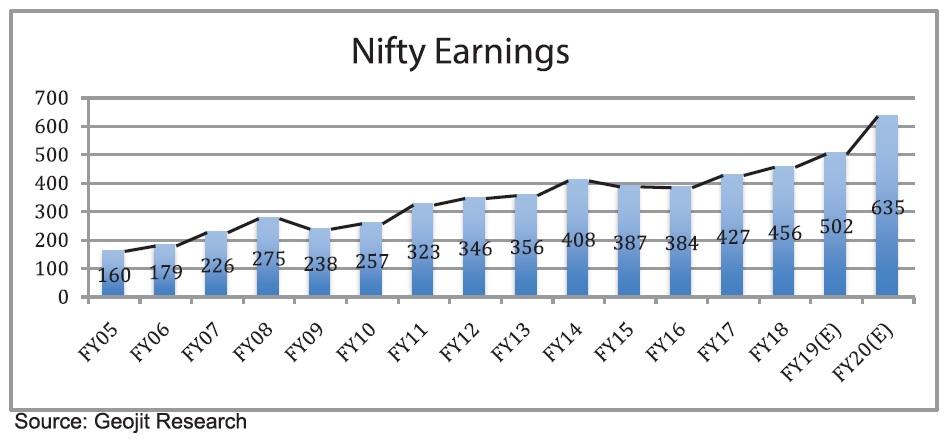

Earnings growth is the key

The noise associated with the general elections will be very shrill this time. Warren Buffet advised long-term investors to “ignore the noise.” But the noise in the coming months will be too shrill to ignore. Therefore, listen to the noise; but without being swayed too much by it, act with conviction. And this conviction should be born out of faith in the India Growth Story and the imminent pickup in earnings growth. The most important factor driving the market after elections would be earnings growth. And, there is very good news here. There is a near consensus that FY 20 earnings growth will be above 20 percent.

After tepid performance of the last four years, Nifty earnings are likely to spurt in FY20 led by corporate banks. This earnings spurt will bring the valuations into fair territory. Therefore, if the elections throw up a market-friendly government, it will be bullish times for the market. In the event of a badly fractured mandate, a short-term sell-off is likely. If it happens that can prove to be a good buying opportunity. It is also possible that the market may discount the election outcome much earlier than the event. Long-term investors can start buying quality stocks, ignoring the noise.