By Joe Varghese Samuel

By Joe Varghese Samuel

Globalisation has always been seen as a way through which different economies and markets around the world become interconnected and interdependent to meet their various needs. It has led to the removal of trade barriers and the sharing of knowledge among different countries. In the aftermath of World War II, politicians around the world had sought to spread globalisation by breaking down the restrictions hampering trade. This led to the Bretton Woods Conference in 1944, in which a framework was made for international commerce and finance. The World Bank and the International Monetary Fundwere established during the conference. In 1947, General Agreement on Tariffs and Trade (GATT) was established as a legal agreement between many countries, whose overall purpose was to promote international trade by reducing or eliminating trade barriers such as tariffs or quotas. This was subsequently succeeded by the establishment of the World Trade Organization (WTO) in 1995. Globalisation has led to increased foreign direct investments, technological innovations and economies of scale in different economies.In the 1990s, the growth of low cost communication networks allowed work done using a computer to be moved to low wage locations for many job types. This included accounting, software development, and engineering design. World exports rose from 8.5% in 1970, to 16.2% of total gross world products in 2001. In spite of this, critics of globalisation have argued that it has led to large trade deficits, loss of jobs locally and replacement of local products with foreign counterparts.

These disadvantages were voiced vociferously during Donald Trump’s presidential winning election campaign in 2016. During his campaign Trump argued for protectionism of the American economy and asserted that decades of free-trade policies were responsible for the collapse of the manufacturing industry. He argued that these policies led to job losses, import of cheap goods and depressed wages. Once Trump came to power, in keeping with his anti-globalisation stance, he proceeded to withdraw from the proposed Trans Pacific Partnership (TPP), a trade agreement between Australia, Brunei, Canada, Chile, Japan, Malaysia, Mexico, New Zealand, Peru, Singapore, Vietnam and the US. He has also threatened to withdraw from the Northern American Free Trade Agreement (NAFTA), a free trade agreement between US, Canada and Mexico.

Tit for Tat tariffs

On March 8th 2018, Trump signed a proclamation to levy tariffs of 25 % on steel and 10 % on aluminium imports into the US, stating that the tariffs were needed to protect the national security of the country by adding more jobs in the steel and aluminium sectors. However, the US was willing to provide exemptions to Canada, Mexico and few other countries that export steel and aluminium, thereby isolating China. In a torrent of tit-for-tat tariffs since, China retaliated with increased duties on 128 US (mostly) farm and food products worth $3 billion. This was followed by the US’s 25% increase in duty on over 1,000 industrial and technology items worth $50 billion, resulting from the United States Trade Representative investigation into China’s unfair trade practices, triggering a matching retaliation from Beijing targeting soybeans, cars and chemicals.

Reasons for protectionism

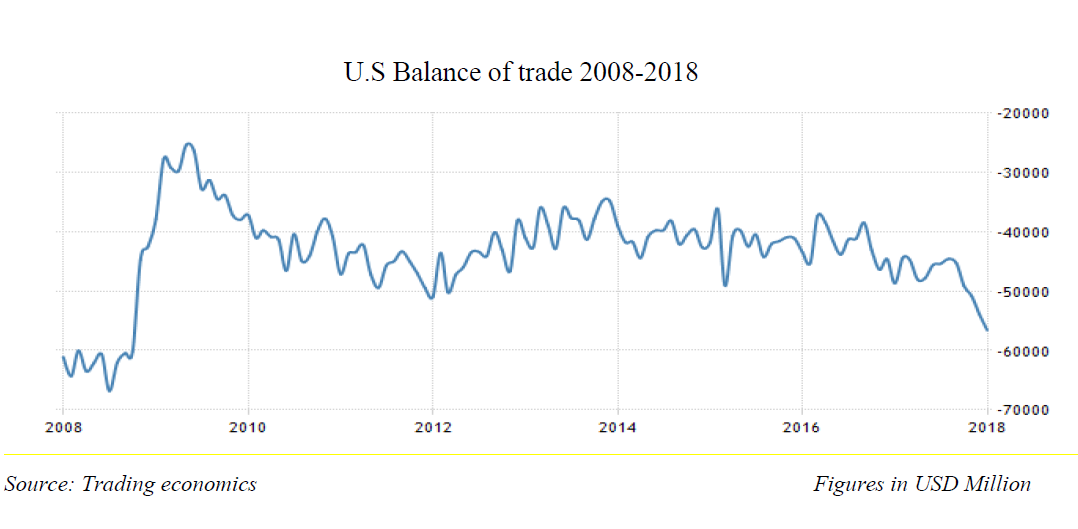

Trump wants to reduce the trade deficit that the US has with other countries. In 2017, the total US trade deficit was $566 billion. It imported $2.8 trillion of goods and services while exporting $2.3 trillion. US trade deficit with China amounting to $ 375 billion accounted for more than 65 percent of the total US trade deficit. The main Chinese imports are consumer electronics, clothing, and machinery. The US aims to reduce trade deficit with China by $100bn through these tariffs. Also, in the case of China, points of legitimate concern included state-owned enterprises, heavy industrial subsidies, intellectual property theft and piracy, indigenous innovation policies, rare earth mineral export restrictions and other trade-distorting practices.

Will India be affected?

Will India be affected?

Currently, India ranks 9th among the US trading partners and has a trade deficit of $2207 million with India. So far, although the US has not levied any tariffs on Indian goods, the US has toughened the approval of H1B visas, which impacts the I.T industry in India, who are major benefactors of H1B visas. A significant number of American banking, travel and commercial services depend on on-site IT workers from India to get their job done. Thus, the increased scrutiny of H1B visas could lead to increased project costs for I.T industries and may also deter these companies from higher reliance on such visas leading to higher onshore hiring.

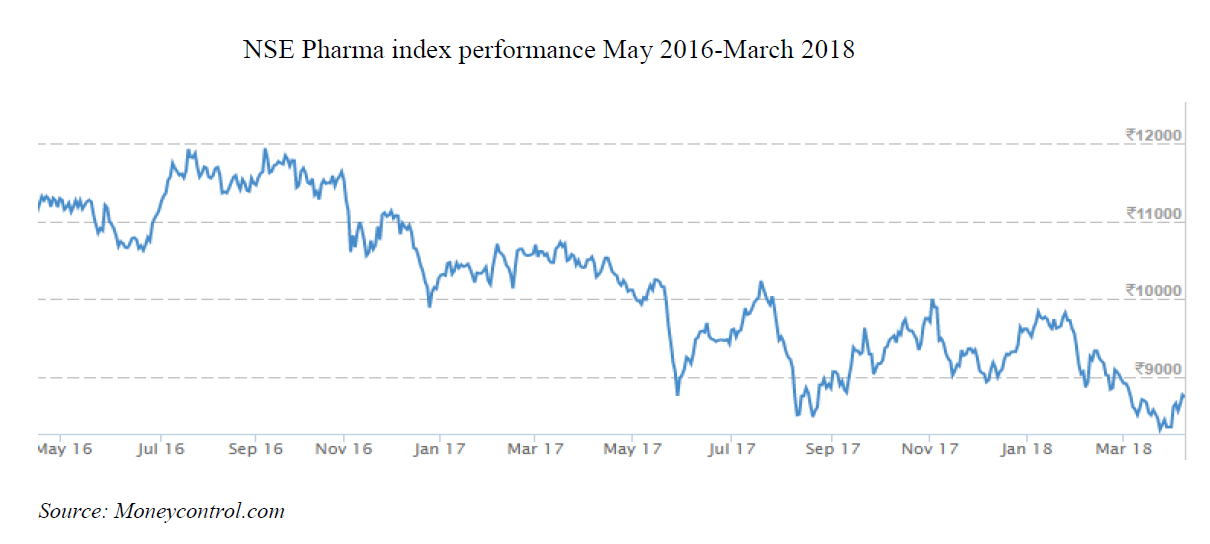

The pharmaceutical industry in India has large operations in the U.S. According to a CARE Ratings July 2017 report, the USA alone accounted for 40.6 per cent of the Indian pharmaceutical exports. IPA data demonstrates that since 2010, Indian pharma investment in US has gone up by over 500 % from Rs 4627 crore to Rs 25,133 crore. However the pharma industry fears a tougher stance on intellectual property rules after Donald Trump asserted that foreign countries must pay a fair share for drug development costs. He aims to lower drug costs and seeks to encourage local manufacturing through these measures. The NSE pharma index as a result has seen a decline in returns since Trump has come into power.

However, in the long run, the new pricing models aimed at reducing drug costs would benefit Indian pharma companies as India-made generics sometimes cost almost one-tenth of branded drugs sold in the US.

In the steel sector, the 25% tariff imposed on steel imports is unlikely to have a direct impact on the Indian steel manufacturers as steel exports from India are only 2% of the total trade exports from the country. However, imposition of tariffs in the US will inevitably force major steel producing countries to divert part of their exports to major steel consuming centres like India. This could distort the domestic market considerably by raising the threat of imports and could lead to falling steel prices.

What’s ahead?

So far, the tariffs announced have not been implemented by either country. This could open up the possibility of both countries engaging in constructive bilateral negotiations. China has already hinted at this solution. “Both sides have put their lists on the table, now it’s time for negotiations,” said Chinese Vice Finance Minister Zhu Guangyao. However, considering the aggressive nature of the tariffs and the global attention this issue has received, it seems highly unlikely that the two countries’ expectations may align in the near future.

The trade deficit the US has with China has been the main issue for Trump and he aims to reduce this deficit by imposing these tariffs. A reduced trade deficit may lead to more job creation and boost manufacturing in the US. The tariffs may also force China to rethink its own protectionist practices related to import duties, intellectual property and so on. However in the long term, there may be an impact globally. China and the US are the world’s two biggest economies, representing 15% and roughly 19% of global output, respectively. If the tariff war continues, the global trade pie will shrink as 34% of the global economy could grow at a slower pace than expected. Prices of goods on which tariffs have been imposed may reduce, which would affect manufacturers of those products. Going forward, an overall impact of these tariffs can only be quantified depending on how many of these tariffs may be implemented by both countries.