The Indian corporate sector does not need to make investments for a few years to remain profitable and even see profits and profitability grow. As a result, investors can expect a free ride of sustained profits growth over the next few years. It would be great if demand picks up. But, in the short to medium term, that may not be a serious constraint. Profits could continue to grow even handsomely because of the government’s generosities.

The Indian corporate sector does not need to make investments for a few years to remain profitable and even see profits and profitability grow. As a result, investors can expect a free ride of sustained profits growth over the next few years. It would be great if demand picks up. But, in the short to medium term, that may not be a serious constraint. Profits could continue to grow even handsomely because of the government’s generosities.

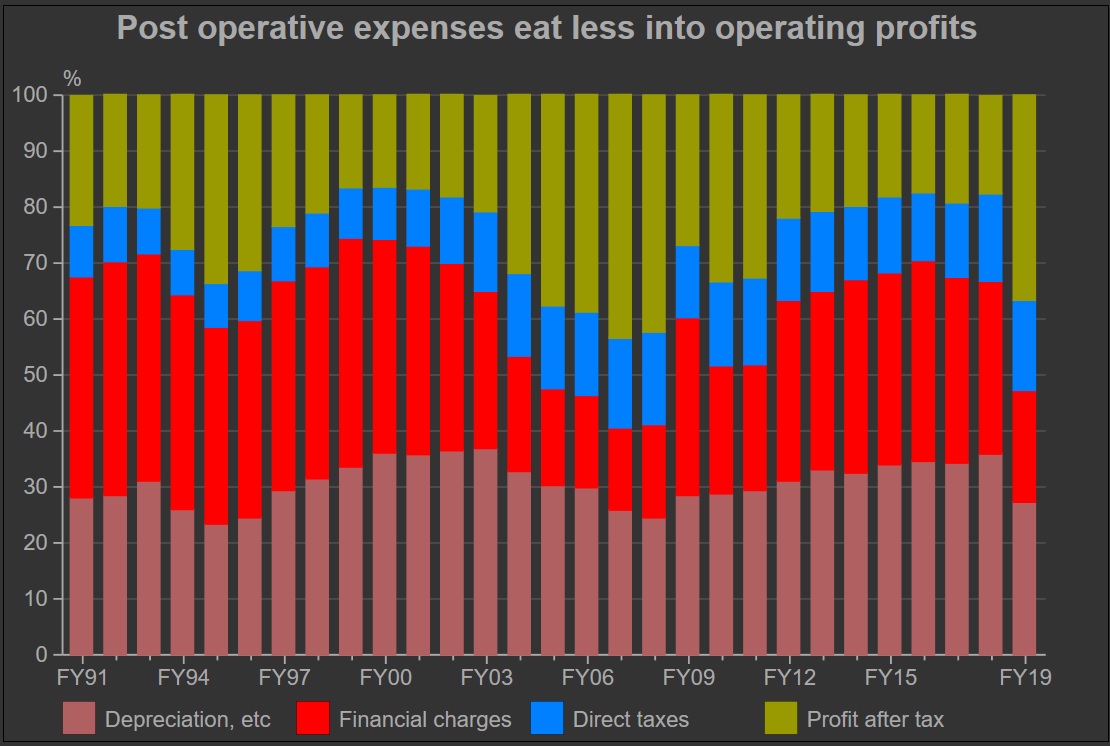

Fiscal 2018-19 saw a big 16.6 percent increase in sales which translated into a 16.3 percent increase in profits before depreciation, interest, tax and amortisation. But, as investments and borrowing slowed down, the profit left after meeting these obligations (profit before tax) grew faster at 22 percent. And, profit after tax grew by 29 percent.

Now, given the low asset utilisation ratio in 2018-19 and the very sluggish growth seen in sales again in 2019-20, the corporate sector does not have sufficient reason to make fresh investments into new capacities. In fact, given the sluggish growth in sales seen in the first half of 2019-20, it may be a perfectly rational decision for companies to postpone capex expansion till the current capacities are fully utilised.

Asset utilisation measured as sales per net fixed assets was 2.16 in 2018-19. This is much lower than the long-term average of 2.5 and the peak value of nearly 3. Sales of listed companies grew by less than 3 percent in the first quarter and, according to results of the first 340 companies, was shrinking in the second quarter.

The extremely sluggish growth in sales in 2019-20 makes the case for any expansion in capacities very weak.

So, if companies do not need to grow their assets, and we already know that assets growth of the corporate sector has already declined sharply in the past few years, then it can be deduced that depreciation charges will grow at a modest pace in 2019-20 and even in the coming few years.

Usually, depreciation charges grow by 10-20 percent a year and account for a quarter of the profits before depreciation, interest, tax and amortisation. In the past three years, this share has declined to less than 22 percent. Given the continued slowdown in growth of assets, it can be safely assumed that the share of depreciation in PBDITA would decline even further.

While depreciation costs would come down because of lack of growth in assets, interest costs are expected to decline because of two reasons. First, because of lack of assets growth companies would need to borrow less and, secondly because the Reserve Bank of India has been continuously and aggressively reducing lending rates. This would finally reflect in falling interest cost of companies.

The share of interest costs in PBDITA has averaged at about 31 percent. This is estimated to have dropped to about 25 percent in 2018-19. Preliminary results show that this has fallen to 20 percent but, this estimate is likely to be revised upwards to about 25 percent. We expect this share to come down sharply in 2019-20 to 20 percent. It could fall even further in the coming years.

This fall in interest rates is a significant bonanza to companies. But, this is not all. There is another bonanza (quite likely a smaller one compared to interest costs) in the form of a cut in direct taxes applicable to companies.

On September, 20, 2019, finance minister Nirmala Sitharaman announced a steep cut in corporate direct taxes from 30 percent to 22 percent subject to the companies not availing any exemption or incentives.

Some companies would gain more than others depending upon the gains already made through existing exemptions that would now have to be foregone. But, at the aggregate level, companies would record a higher growth in profit after tax given a profit before tax.

Assuming that operating profits remain stable, net profits and profitability would grow at a good clip because of lower growth in depreciation charges, lower growth in interest costs and lower direct taxes.

Headline reports in both, Business Standard and Economic Times of October 30, 2019 suggest that the government could cut taxes further. Economic Times suggested there were “hopes of tax sops for equity investors” and Business Standard ran the following headline “Dividend distribution tax may be scrapped”. If these reports are true, the free ride may just become a lot more exciting for investors.

This is a good time for companies to focus on their operating profit margins, the rest of the profit growth is free. We have seen that the corporate sector has been making good progress in ensuring better operational efficiency and, there are no visible signs of commodity prices moving adversely either. Therefore, the threat to their operating margins is small.

The only threat to corporate profits is shrinking demand. The fall in sales growth in the first half of 2019-20 is worrying.

Assuming that both, assets and sales do not grow, net profits could grow by nearly 30 percent in 2019-20. If Corporate India does not invest in the next two years but merely raises the asset utilisation to the long-term average of 2.5 its profits would grow further and so would its profitability.