by Mahesh Vyas

Although the March 2018 quarter disappointed with very poor growth in net profits, it holds out a promise in the form of rising profit margins.

Net profit margin adjusted for prior period and extraordinary transactions (PAT net of P&E, and henceforth just net profit margin for brevity) has grown steadily from 5.2 per cent in the June 2017 quarter to 6.2 per cent in the September 2017 quarter, then 6.4 per cent in the December 2017 quarter and now 6.9 per cent in the March 2018 quarter.

While net profit margins are still low compared to their levels till 2010, their sustained ascent in the past three quarters is worth noting because such a sustained rise in net profit margin is not common. Admittedly, three consecutive quarters of increasing profit margins do not sound like such a big deal but, it may well be one since it happens so rarely and may be so because in the recent past such a phenomenon signaled a change in direction.

In the past 60 quarters such a phenomenon occurred thrice before. When it happened in the quarter ended April 2004 it seems to have signaled an upturn in margins; in the quarter ended September 2007 it signaled a reversal to a downturn and in March 2014 a reversal again to mark an upturn.

We see no logic or reason in the occurrence of three consecutive quarters o f rising net profit margins to lead to a change in direction of the margins. These are mere observations.

But, unlike in the past, when three consecutive quarters witnessed a continuous increase, in 2017-18 they also saw a perceptible improvement in the distribution of profit margins.

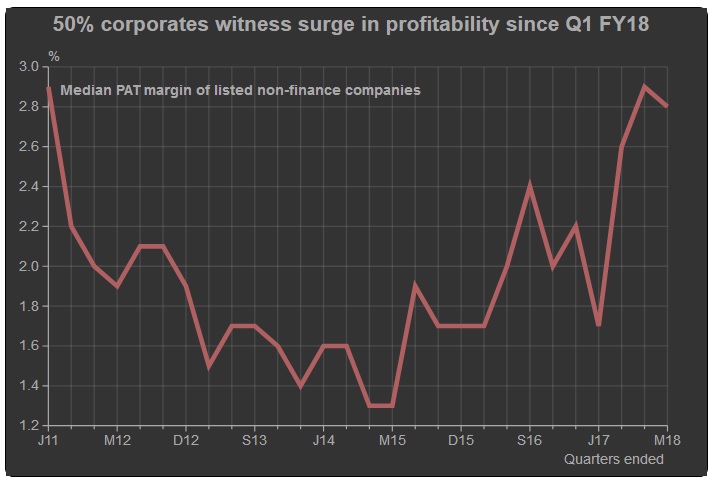

The overall net profit margin of the non-finance sector is dominated by the larger companies since these have a larger weight in the overall estimates. But, the median is not similarly influenced by larger companies and it therefore is a lot more stable than the mean. Even this relatively stable measure of profitability has moved up in recent quarters.

The median net profit margins in the three consecutive quarters – ended September 2017, December 2017 and March 2018 – have been consistently higher than their levels during anytime in the preceding six years.

The four-quarter average median net profit margin of non-finance companies ended March 2018 was 2.5 per cent. This was the highest since the quarter of September 2011, i.e. highest in over-six years. This implies that during the past three quarters, half the listed companies have seen their best net profit margin in over six years.

At the higher end of the spectrum – i.e. at the 75th percentile, the net profit margin has improved to over-9 per cent in the recent three quarters. This is better than the margins at this cutoff during any time since 2010, i.e. in the last seven years.

The lower end of the spectrum does not see such an impressive improvement. The bottom quartile companies usually record a loss or no profit or extremely thin margins. This segment has been recording losses consistently over the last seven years. The losses were the worst during 2015 and there has been a recovery from those levels. However, the recovery is not good enough to take the net margins back to the levels they were in 2010 or 2011 as in the case of the median or the higher quartiles.

Evidently, while there is improvement in profit margins at the higher end of the PAT margin distribution, the lower end has not seen much improvement.

Further, while there is an improvement in the net profit margin of companies, the margins around the median are quite thin at less-than 3 per cent.

The phenomenon of rising net profit margins is essentially of manufacturing companies. It is not seen in non-finance services companies, mining or electricity companies. In terms of size, it is the manufacturing sector and the non-finance services sectors that matter. Net profit margins in the manufacturing sector are usually lower than those seen in non-manufacturing companies. The non-finance services companies have margins that are a shade higher than that of manufacturing companies and these seem to be stagnating. In contrast, margins of manufacturing companies seem to be rising.

Sustained increase in overall net profit margins over the past three quarters, a perceptible increase in the margins at the higher middle-to-higher end of the spectrum indicates some undercurrents of a turnaround in the performance of the corporate sector. And, the turnaround story could be scripted by manufacturing companies.