By Vinod Nair

By Vinod Nair

The Indian equity market was under a euphoric performance over the last 2 years with limited volatility providing a handsome return of 45% on absolute basis. The outlook for 2018 is moderate (please see Jan edition), and as anticipated we have entered into a volatile phase, under which we have to understand the root of the matter and play accordingly to outperform. Start of the year was good led by 6.3% return in the month of January led by strong FIIs and MF inflows. But some setback from the Union Budget (especially for equity class) and headwinds in global market have turned the trend to be cautious in the short to medium-term.

A short-term impact from budget… overall it’s growth oriented

Two major factors which are directly impacting the capital market are: introduction of Long-term Capital Gain Tax (LTCG) without tweaking STT (Security Transaction Tax) and slippage in fiscal deficit.

Fiscal breakout…

In this budget, the capital market was expecting a good balance between fiscal deficit and growth. But in spite of tightness in government’s finance, budget maintained its long-term growth plan by accepting some slippage in fiscal deficit during the medium-term while maintaining the long-term deficit plan as per Fiscal Responsibility and Budget Management (FRBM). The main reason for the shortfall in the government’s financials were lesser tax and non-tax revenue due to impact of demonetisation and GST (key reforms for long-term benefit). This resulted in lower GDP growth for FY18 as economic activities were reduced to address the changes in doing business. Additionally tax revenue from GST was only for 11 months.

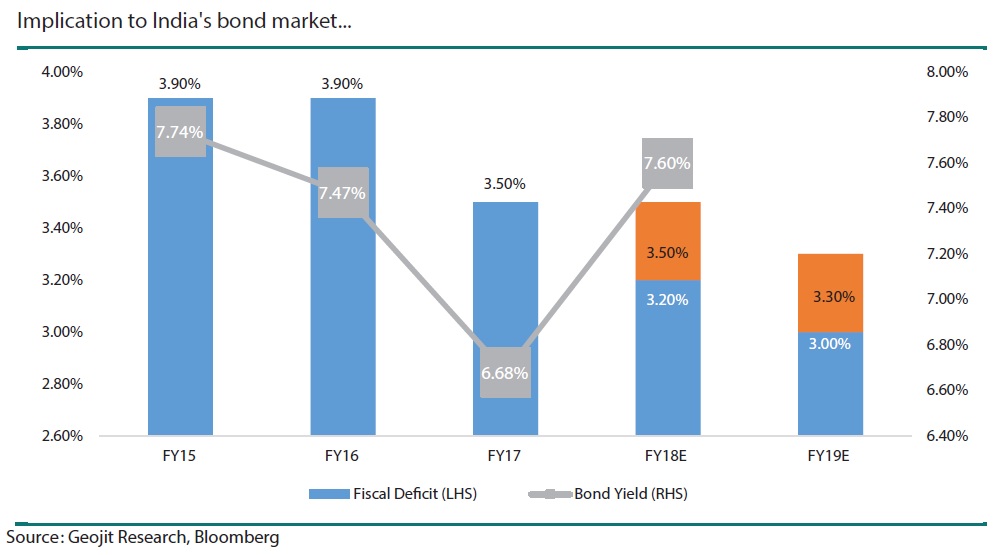

Fiscal deficit was revised higher to 3.5% in FY18 compared to 3.2% targeted earlier. We feel that this may have been largely factored by the market but continued slippage in FY19E to 3.3% from the earlier target of 3% has impacted the market. Bond yield of 10 year GSec fired to unanticipated level, up by more than 120bps from 6.5% to 7.7% in the last 6 month. This will impact the equity market due to increase in cost of funds and inflation while valuation downgrades. Government borrowing was about 38% more in FY18 then forecasted. This pressure on bond yield will be a challenge as government’s financials stabilise, retail inflation moderates and US fed rate hike are controlled.

Capital Gain Tax

Introduction of 10% LTCG on gains exceeding Rs 1 Lakh without indexation, but with grandfathering till the closing price of 31st January, 2018, may hurt investors in the near-term. Please note that it was expected to be introduced in India in the long-term, but the timing had a surprise effect. This is also applicable to equity oriented mutual funds. Also dividend distributed by equity-oriented MFs will be taxed at 10 %. These taxes may be a setback given the growing inflow of common investors through SIP in the last 2-3years. The short-term tax has been maintained at 15%; a low gap between LTCG and STCG may be a point of concern in future.But market and investors are likely to be mature and absorb the change in the near-term.

It’s a good budget under the circumstances

As anticipated the focus was more towards the rural economy.Though it may have a populist agenda, more expenses towards the rural market without overwhelming spending will be positive in the long-term. It is a fundamental need to address the requirement of all sets of people and provide equal opportunity for income and standard of life. The budget focuses on improving the livelihood of rural population by addressing the need of agriculture, increase in MSP, job creation and allied infrastructure. Please note that rural economy accounts for 45% of India’s economy with 70% of our total population. Hence effective spending in rural market will help the economy in the long-term. In a nutshell, the budget has provided a good outlook for GDP in the future, higher tax collection, spending in urban & rural infrastructure, slippage in fiscal deficit, increase in farm’s income and introduction of long-term capital gain. Government decided to maintain the growth plans as fiscal improves over the long-term.It is likely to be positive for FMCG, staple consumer sector, agro sector like fertilisers, two wheelers, tractors, micro finance and so on.

Market has shifted to global volatility…

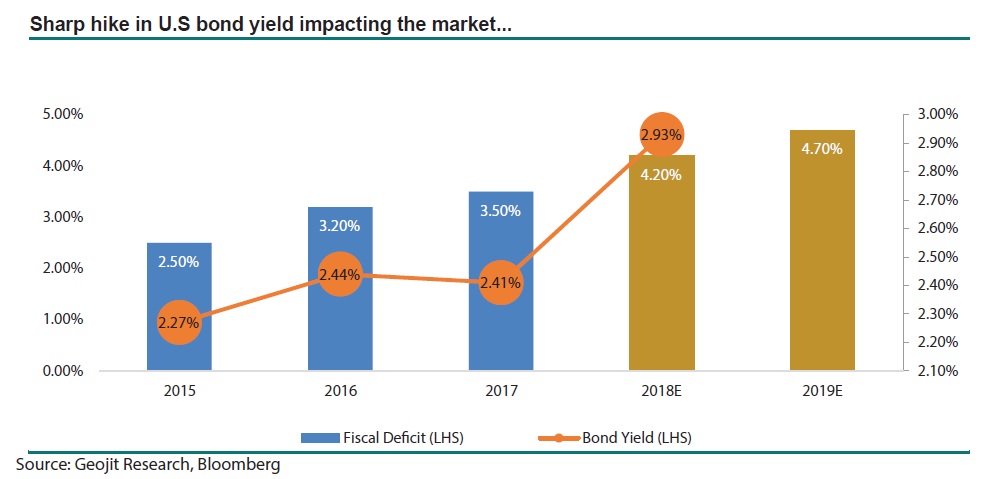

The fall in the domestic market which was initiated through a setback in the budget got extended due to global clampdown. The global factors were premium valuation, inflationary pressure, increasing the gap in US fiscal deficit as a result more than anticipated increase in US fed rate.The market shifted into a tactical play-out, moving financial assets from equity to bond. This trend may continue as valuation stabilize to a normal level along with reduction in bond yield. Dow Jones fall by 12% on a intraday basis from 26th Jan to 9th Feb. From this low Dow has recovered by 5 to 6% (till 16th Feb) during which US 10yr bond yield has not increased further. Global investors are looking for a bargain after the last week’s collapse which was the weakest weekly loss in the last 18months. Also till date there is no change in long-term outlook with forecast for strong earnings growth in the future.

Sharp hike in U.S. bond yield impacting the market…

Volatility will play with the market on the way

Volatility is bound to stay during the year. But a sharp correction in the domestic market led by the double whammy of below expected budget and global clampdown has provided an opportunity for short-term investors to catch-up in the game. Some other factors which are encouraging investors to accumulate are: prospects for better economic growth, earnings revival and supportive macro data.

The forecast for India’s GDP is expected to be better from third quarter onwards from 6.3% in Q2 to 7.5% by FY19. The results for Q3FY18 has been marginally better than expected while latest CPI data suggest a marginal decline in January inflation. Industrial production has improved to the second best in the year to 7.1% showing that India’s economic activities are stabilising.

But during the same time defensive sectors like pharma and IT are outperforming as high valuation, inflationary pressure and possibility of rate hike in late CY18 continue to influence investor’s sentiment.

A neutral stance from RBI and no hike in the US Fed rate can support for a recovery in the short-term since a large portion of an increase in interest rate may be factored in the bond prices. Government 10 year yield has recovered by 20bps from a high of 7.7% to 7.5%.The beneficiaries from this uptick may be interest rate sensitive stocks like NBFC, private banks, infrastructure and two and four wheelers. At the same time global beneficiaries will be metals and export oriented. Please note that volatility will be a game in this uptick and profit booking can be expected anytime as market reaches near the last high.