.

Highlights:

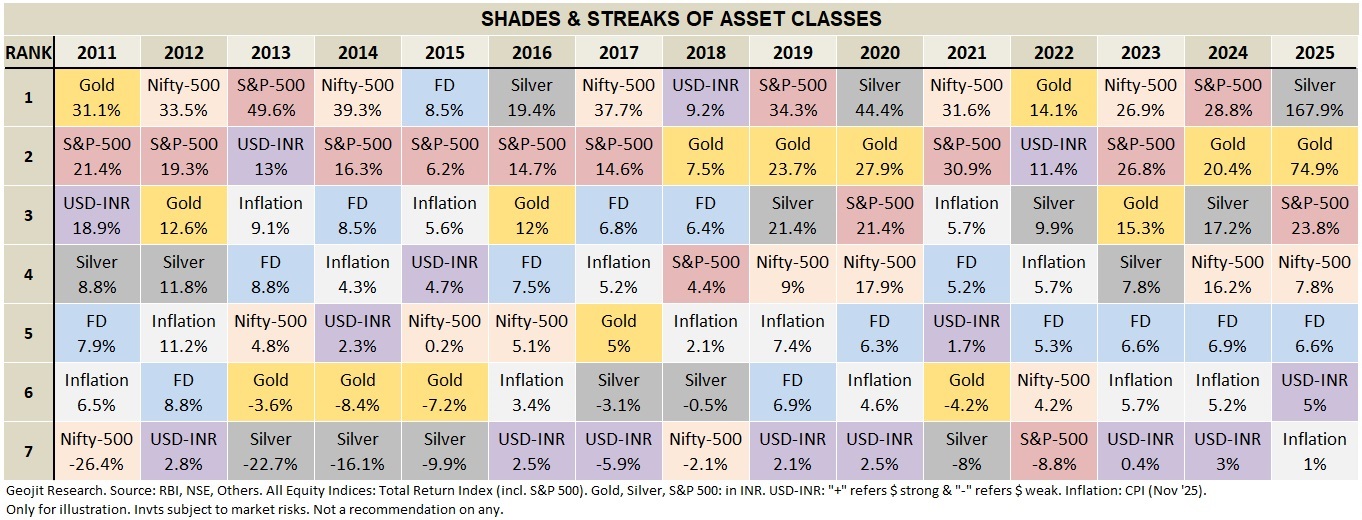

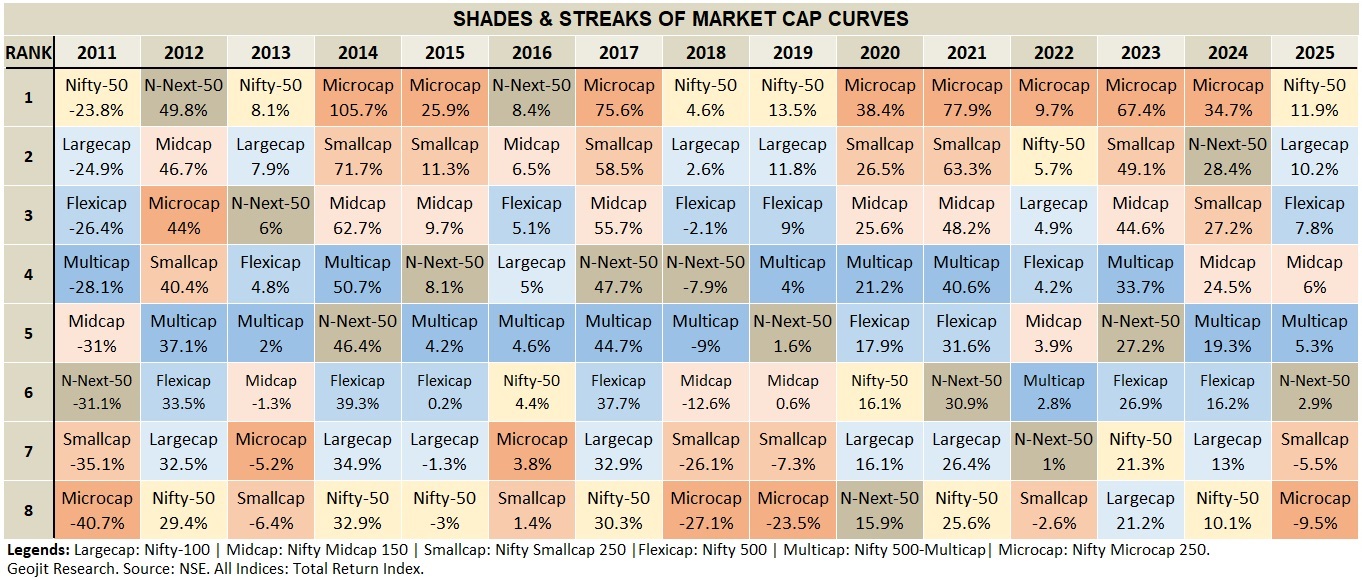

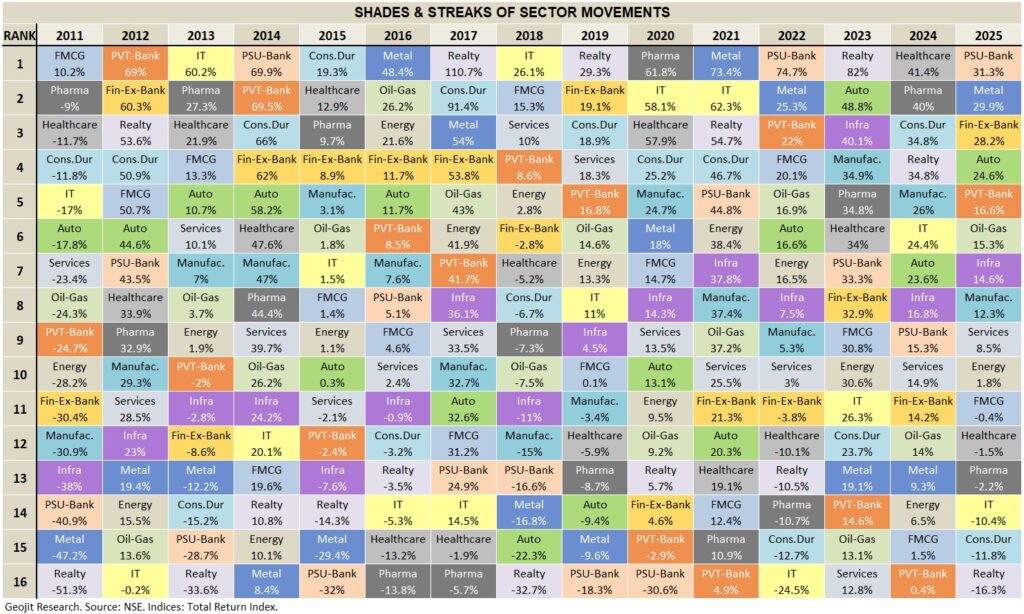

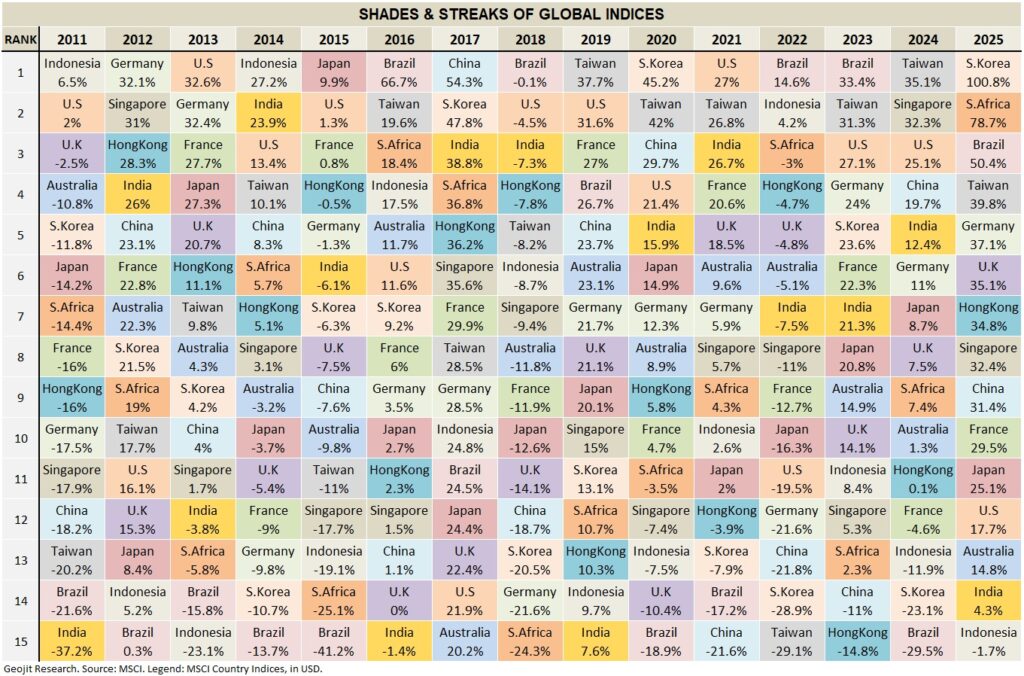

- 2025, like most other years, saw a fair share of rotation across Asset Classes, Market Cap Curves, Sectors, Factors and Global Indices.

- Asset classes: Precious Metals took the limelight, significantly outperforming other asset variants. They had one of the best Calendar Year rallies. This was followed by US equities represented by S&P 500. Indian Equities (read, Nifty-500) lagged overall, amidst roller-coaster year and despite a whole recovery from the lows of Feb/Mar ’25. Fixed Income saw volatility in yields, though the headline policy rates were cut during the year. Rupee fell against USD, higher than the past 2 years, in turn adding to the returns of Precious Metals and US Equity. Inflation cooled off to multi year lows.

- Market Cap curves: The 2025 stack was very different from 2024. Nifty-50, the house of Bluechips, stood better, reversing it’s position from previous years. Small and Microcaps suffered declines and drop in ranks.

- Sectors: Most of them across the board, saw sharper movements through the year. Looking at 2025, PSU Banks, Metals, Financial Services, ex-Banks did better. Realty, Consumer Durables, IT were weaker.

- Factors: Value did well, repeating the show of 2022 and 2023, followed by Low Volatility. Quality and Momentum faced headwinds through the year and settled lower.

- Global Indices: It was a challenging year for most Global Markets and 2025 saw major rank reversals of certain countries. South Korea lead the pack of key global indices, followed by South Africa and Brazil. Indonesia, India and Australia closed lower.

One should note that asset classes, market cap curves, global indices, etc can behave very differently in short-term and when looked at from medium to long-term.

We would like to quickly recollect the foundational aspect of investing – to maintain an ideal asset allocation and market cap allocation from a medium to long term horizon, instead of chasing or reacting to the short-term movements.

.

.

.

.

.

.

Standard Disclaimers apply.