- In Q2FY26, APNT delivered strong volume growth of 10.9%, driven by early festive demand, increased brand spending, product regionalization effort, and an expanding B2B network.

- Despite aggressive marketing spend, EBITDA margin improved by 242 bps YoY, supported by deflation in RM price (~1.6%), backward integration and better product mix.

- The company’s key backward integration projects, such as the white cement plant in Dubai, are commissioned, while the VAM/VAE project is to be commissioned in Q1FY27 to support margins.

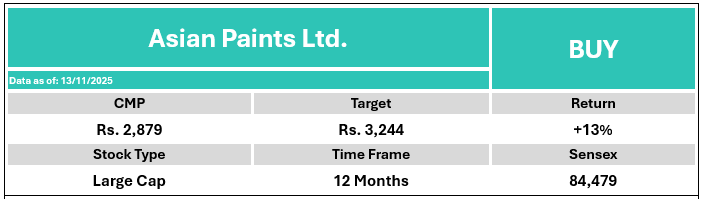

With the company’s ongoing B2B expansion and product regionalisation efforts, we expect volume growth to improve to mid-single digits in FY26. A better product mix and soft input costs should further support earnings. We therefore revise our rating to BUY from HOLD with a revised target price of Rs. 3,244, based on a 55x P/E on FY28 EPS.