Indian Equities has been in correction and consolidation mode since Oct-2024 and till Sep-2025. This came on the back of key Domestic and Global factors. During this period Gold & Silver had shown a phenomenal rally in prices, also helped by the weakness of Rupee.

While the future performance of these asset classes remains to be seen, let’s see how the long-term returns has been for Equities, Gold and Silver, observing the data from 1995 till Sep-2025 – a span of 30+ years.

This analysis is done using Rolling Returns approach. Rolling Returns provides inroads to the overall performance, taking into account the best periods, worst periods and everything in between, without any particular point-to-point or recency biases. This gives a better picture on the overall performance and return behaviors.

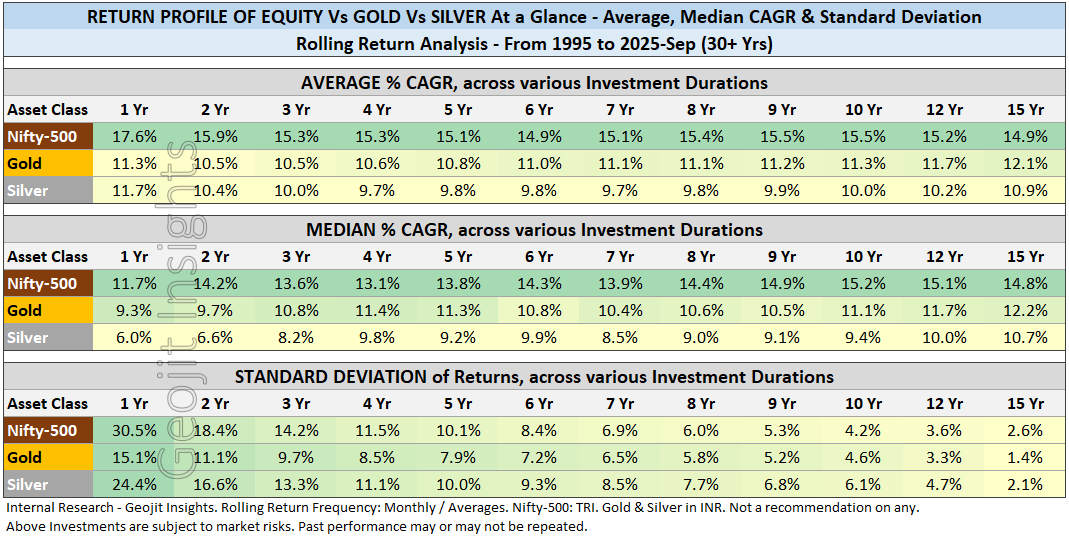

Average & Median CAGR:

- Equity (represented by Nifty-500 Index, a Flexicap style that includes Largecaps, Midcaps and Smallcaps), exhibited better Average & Median CAGR across Medium to Longer-time frames, based on the Rolling Returns Analysis, of data from 1995 till Sep-2025.

- Standard Deviation moderates and reduces with increase in the investment duration, across the three asset classes in reference.

- Silver shows relatively more volatility, in certain medium to long time frames.

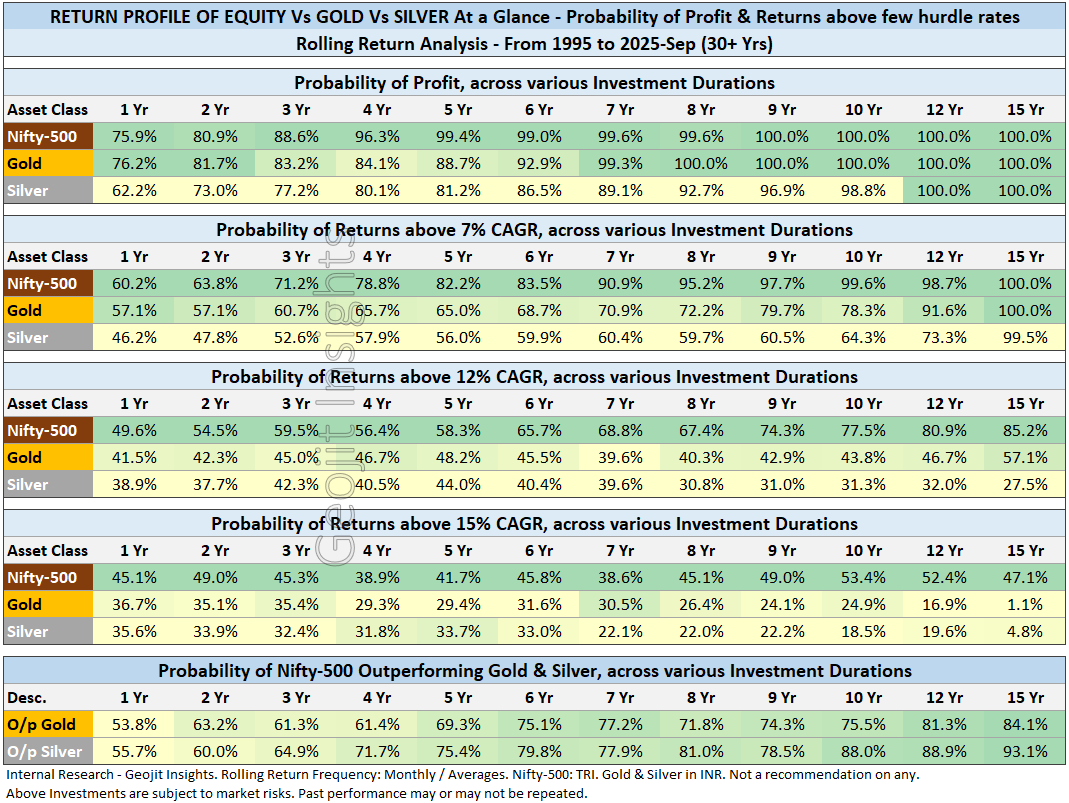

Probability of Profit & Probability of Returns beyond few Hurdle Rates:

- Equity, Gold and Silver had higher probability of Profit over years

- Equity had shown good probability of beating 7% CAGR mark (above the long term average general Inflation levels), beyond 6 years, followed by Gold and then by Silver.

- Probability of Returns above 12% & 15% CAGR: This is where Equities have shown a differentiated outcome. Equity displayed higher probability of returns beyond 12% and 15% CAGR over medium to long-term, than Gold & Silver.

- This analysis also revealed, that over time, Equity had out-performed both Gold & Silver across medium to longer duration.

- This is an important data to be aware of, while setting an expectation of returns from various asset classes, over different investment horizons.

- Please note Asset Allocation works well at all times. It endeavours to give better risk-adjusted returns at the portfolio level, over a period of time.

Post by: Sriram BKR