Vikram Solar Ltd. (VSL) is a leading Indian solar energy company specializing in high-efficiency photovoltaic (PV) modules. The company operates two strategically located manufacturing facilities: a 3.20 GW plant at Falta SEZ in Kolkata, West Bengal, and a 1.30 GW plant at Oragadam in Chennai, Tamil Nadu. As of June 30, 2025, VSL ranks among India’s largest pure-play module manufacturers, with 2.85 GW of capacity listed under the Ministry of New & Renewable Energy’s Approved List of Modules and Manufacturers (ALMM). Its key domestic clients include NTPC, Adani Green, JSW Energy, and Neyveli Lignite, while international clients include PureSky and Sundog Solar.

Key Highlights

India’s solar manufacturing sector is witnessing rapid expansion, with 91GW of module capacity and 25 GW of cell capacity as of June 2025. Between FY26 and FY30, the country is expected to add 150–170 GW of solar capacity, driven by strong policy support and rising demand. (Source: CRISIL Intelligence).

VSL’s revenue grew at a 29% CAGR from ₹2,073cr in FY23 to ₹3,424cr in FY25. By FY25, the company achieved a PAT of ₹140cr, reflecting a CAGR of 211% over the FY23-25 period. Debt-to-equity ratio improved from 2.2x in FY23 to 0.2x in FY25.

In FY25, VSL reported EBITDA and PAT margins of 14.4% and 4.1%, respectively, trailing peers due to limited backward integration and a lower export mix. Margins are expected to improve with the planned addition of cell manufacturing. The company delivered a RoE of 11.3% and RoCE of 17%.

As of March 2025, the company had an order book of 10.3 GW, 2.3x its current rated capacity of 4.5 GW.

The company plans to scale its module manufacturing capacity from 4.5 GW to 15.5 GW by FY26 and further to 20.5 GW by FY27, including a 3 GW facility in the U.S. to localize its supply chain.

Vikram is entering the fast-growing battery energy storage system (BESS) market to capitalise on increasing demand with a 5 GWh facility by FY27.

The company is pursuing backward integration with plans to establish 3 GW and 9 GW solar cell manufacturing units in Tamil Nadu by FY27. This will reduce import dependency, enhance cost and quality efficiencies, and safeguard margins against input price volatility.

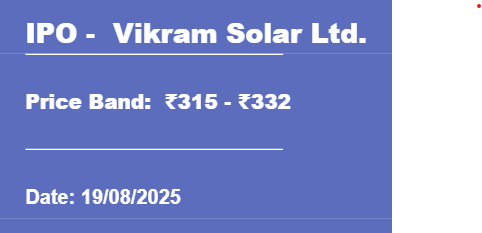

At the upper price band of ₹332, Vikram Solar is valued at 25x EV/EBITDA (FY25), which is reasonable relative to peers. Despite a stretched P/E compared to peers, improving margins, reduced debt, and a strong order book support its growth outlook. Backed by policy tailwinds, aggressive expansion, backward integration, and entry into energy storage, the company is well-positioned to benefit from India’s renewable energy push. Hence, we recommend a ‘Subscribe’ rating on a long-term basis.