Attractive valuation and sustainable growth

Federal Bank Ltd. (FBL) is an Indian private commercial bank, headquartered in Kerala. FBL owns 1,550 banking outlets with a gross advances size of Rs.2,33,749cr.

Key Highlights

Gross Advances grew modestly at 15% YoY, driven by a 49% YoY increase in Agri loans and a 20% YoY increase in SME loans. Deposit growth advanced by 11% YoY, with CASA accounts growing by 10% YoY. The CASA ratio stood at 30%.

Net Interest Income grew by 15% YoY to Rs. 2,431cr. The Net Interest Margin (NIM) stayed flat at 3.1% sequentially.

Slippages have increased marginally to Rs.484cr compared to Rs.428cr in the last quarter. But GNPA/ NNPA has improved to 1.95%/ 0.49% from 2.29%/ 0.64% in Q3FY24.

PAT de-grew marginally by 5% YoY to Rs. 955cr due to a 220% YoY increase in provisions, attributed to an increase in slippages.

Provision Coverage Ratio (PCR) was marked at 74.2%, up from 71.0% in Q3FY24.

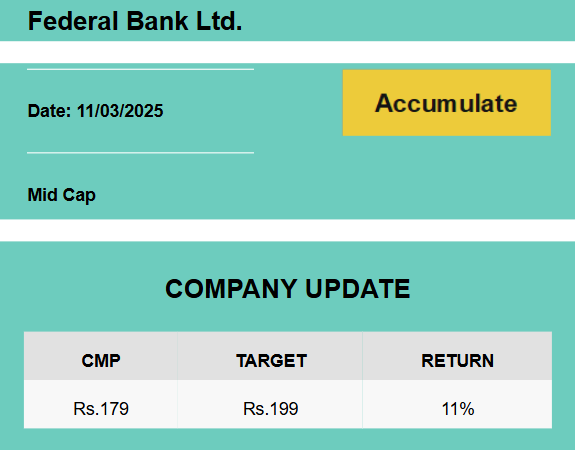

OUTLOOK & VALUATION

Under new management, the bank is focusing on a granular growth strategy that prioritizes sustainable and high-quality asset and liability management. While this reorientation may cause short-term challenges and medium-term pressure on the NIM, the bank is confident that better management of CASA and shifting the loan structure from floating to fixed will improve the NIM trajectory. With valuations returning to long-term averages, we upgrade our rating to Accumulate with a revised target price of Rs.199, based on 1.2x FY27E BVPS.