Tariff repair helps India mobile business shine

Bharti Airtel Ltd (Airtel) is a leading global telecommunications company with operations in 15 countries, including Asia and Africa, and ~577mn customers as of Q3FY25.

Key Highlights

Consolidated revenue grew 19.1% YoY to Rs. 45,129cr in Q3FY25, led by growth in revenue from India, constant currency growth in Africa, and the consolidation of Indus Tower Ltd with effect from November 2024.

Revenue from India increased 24.6% YoY to Rs. 34,654cr, driven by growth in Mobile services (+21.4% YoY), along with the impact of tariff repair in the segment and strong growth in Home businesses (+18.7% YoY).

Revenue of Airtel business and Passive Infrastructure Services increased 8.7% YoY and 5.7% YoY, while the digital TV revenue was down 2.9% YoY.

Average revenue per user (ARPU) was reported at Rs. 245 in Q3FY25 compared with Rs. 208 in Q3FY24.

EBITDA rose 21.4% YoY to Rs. 24,597cr in Q3FY25, aided by higher topline and drop in other expenses. Thus, EBITDA margin improved 110bps YoY to 54.5%.

Reported Profit After Tax (PAT) increased 460.9% YoY to Rs. 16,135cr.

OUTLOOK & VALUATION

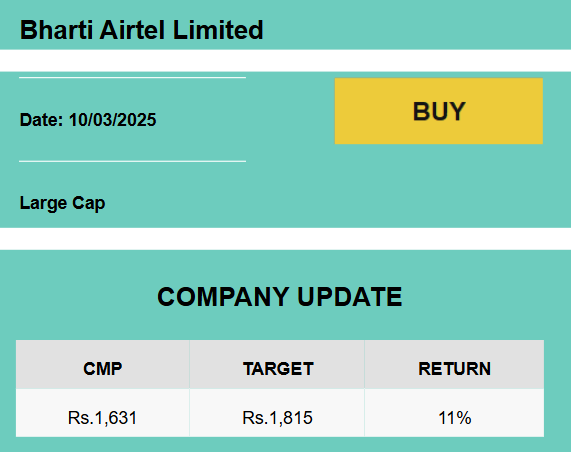

During Q3FY25, Airtel’s business outshined on account of tariff repair, thus, India mobile business outperformed. The company’s ARPU remained to be the best in the industry, with a rising customer base. Its continued focus on diversifying its portfolio across India and Africa and the Indus Tower Ltd consolidation indicates a positive impact in the long term. Airtel’s 5G expansion, which is on track, strategic partnership, price structure simplification to gain market share and improving completeness addressing customer and market requirement are expected to drive its overall performance in the long run. Hence, we reiterate our BUY rating on the stock, with a rolled-forward target price of Rs. 1,815 based on the Sum Of The Parts (SOTP) methodology.