Solid performance with growth potential

Incorporated in 2019, Hitachi Energy India Ltd operates in power technologies and makes a range of products across the grid’s value chain.

Key Highlights

Revenue from operations increased 27.2% YoY to Rs. 1,620cr, supported by a favourable execution mix and enhanced operational efficiencies.

Revenues of key segments delivered impressive growth. Transmission (without HVDC) increased 28% YoY, while industries soared 60% YoY. Data centres jumped 615% YoY. However, the renewable-energy segment witnessed a 68% decline (management said the decline was seasonal).

The company achieved its highest-ever order backlog of Rs. 18,994cr, ensuring strong revenue visibility for the upcoming quarters. The execution rate declined to 8.2% from 14.5% in Q3FY24.

Exports (excluding the HVDC order) contributed over 40% of total orders, with key projects in Indonesia, Canada, Croatia and Azerbaijan.

At the operating level, EBITDA rose 145.5% YoY to Rs. 167cr, resulting in a robust double-digit EBITDA margin of 10.3%

PAT rose 498.1% YoY to Rs. 137cr, driven by favorable execution mix and notional forex gains on export order deliveries.

OUTLOOK & VALUATION

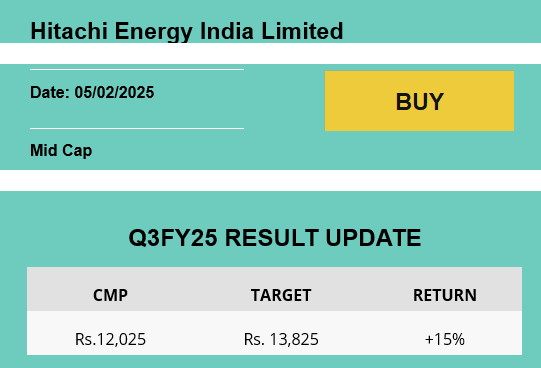

Hitachi Energy reported robust financial performance with notable improvements in both top line and bottom line. The company grew across key metrics, driven by its leadership in core segments. These factors, along with the highest-ever order intake, a strong order backlog and ongoing capacity expansion, indicate a promising growth trajectory, and Hitachi is well-positioned to capitalise on emerging opportunities. Therefore, we upgraded our rating on the stock to BUY, with a rolled forward target price of Rs. 13,825, based on a target multiple of 55x P/E on FY27E adjusted EPS.

To read our detailed research report,