Stress from MFI segment far from over…

Ujjivan Small Finance Bank Ltd. (USFL) serves over 93 lakh customers through 24,290+ employees. USFL is the 3rd largest SFB with a loan book size of Rs.30,466cr and a deposit base of Rs.34,494cr.

Key Highlights

Gross Advances grew modestly at 10% YoY, driven by a 45% YoY increase in Affordable Housing and a 57% YoY increase in Financial Institutional Group lending. Deposit growth advanced by 16% YoY, with CASA accounts growing by 15% YoY. The CASA ratio stood at 25%. The bank is diversifying its product suite to reduce reliance on the microfinance segment, which has faced challenges. By increasing the proportion of secured assets, such as affordable housing loans, MSME loans, vehicle loans, and gold loans, the bank aims to lower its overall risk profile. This shift is evident as group loans experienced a 12% YoY decline. Net Interest Income grew by 3.1% YoY in Q3FY25, impacted by falling yields on advances and slower advance growth. Additionally, NIM contracted by 60 bps sequentially to 8.6%. The microfinance segment has faced significant challenges, leading to increased stress. The PAR for the group loan portfolio rose to 6.6% in December 2024 from 4.1% in June 2024. GNPA and NNPA have deteriorated to 2.7% and 0.6%, respectively, from 2.1% and 0.2% in Q3FY24. Due to increased stress in the microfinance segment, provisions have risen by 254% YoY to Rs. 223cr, weighing on the PAT, which has decreased by 64% YoY to Rs. 109cr.

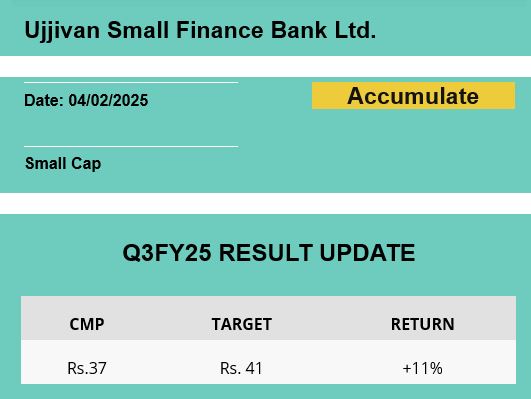

OUTLOOK & VALUATION The ongoing stress in the microfinance segment is expected to keep credit costs elevated throughout FY25. The bank’s strategic measures, including enhanced collections, a focus on secured lending, and a prudent approach to microfinance, are positive steps towards managing and reducing credit costs in the long term. The shift in portfolio mix is expected to impact NIM negatively. With asset quality stress in group loans stabilizing, the ROA is expected to improve from FY26 onwards. Therefore, we reiterate the ACCUMULATE rating on the stock with a revised target price of Rs. 41 based on 0.95x FY27E BVPS.

To download our research report on Ujjivan Small Finance Bank Ltd., click here.