By Krishna Prasad NB

Commodity traders will have to overlook many factors ranging from growth of global economy and policy measures from major central banks this year. Several macroeconomic headwinds are expected in the commodity segment this year. The year 2021 was favorable for commodities and various segments from energy to base metals outperformed with considerable gains. Although optimism over the global economic recovery countered gains, precious metals remained comfortably above the pre-pandemic levels mainly on stagflation concerns and pushing out concerns on interest rate hike expectation.

Major central banks across the globe have laid out plans to end pandemic era stimulus measures. It is mainly to tame inflationary pressure caused by the liquidity injection by central banks and to reduce the supply-demand imbalance. The US inflation remained well above the Federal Reserve’s long-term objective of 2.0 percent for some time and saw the biggest jump in nearly four decades in November 2021. US central bank started its stimulus tapering measures as the bank remained confident about its economic growth and labor market, opening doors for a three-quarter percent interest rate hike by the end of 2022, and two hikes in 2023 and two more in 2024. Meanwhile, the Bank of England made a surprise a move by raising interest rates for the first time in more than three years, while the European Central Bank has planned a gradual withdrawal of the extraordinary pandemic stimulus.

The International Monetary Fund (IMF) gave projections of global economic growth at 5.9 percent in 2021 and 4.9 percent in 2022 in its October World Economic Outlook, which is a tad lower from July’s projection owing to logistical problems and unequal administration of vaccines across the globe. But the rapid spread of new virus variant Omicron is likely to force IMF to reconsider its economic projections in its next report.

Gold prices remained steady in 2021 after recording growth in late 2019 and 2020 when Covid-19 broke out. The performance of the yellow metal with respect to other commodities was almost muted last year. This is despite the fact that global economies started to recover growth momentum, and saw improvements in risk sentiments along with firmer greenback and US bond yields. Gold ETFs, the popular vehicles for investing in the yellow metals, have registered net outflows globally in 2021. In its recent monthly report the World Gold Council remarked that ETFs have experienced outflows in six of the first 10 months of the year 2021. In the London Bullion Market Association (LBMA) spot platform, gold prices started to consolidate after a price recovery towards USD 1900 per troy ounce in the second quarter of last year. On the other side, silver in LBMA spot platform hit multiyear high of USD 30.03 per troy ounce and corrected downwards by more than 25 percent. In 2022, rising interest rates, surging bond yields and a firmer US dollar are likely to leave the prospects of yellow metal gloomy. However, the ambiguity in containing the new virus variant in key economies, continuous surge in inflation, uncertainty in employment and economic growth may improve the appetite for safe haven assets like bullion.

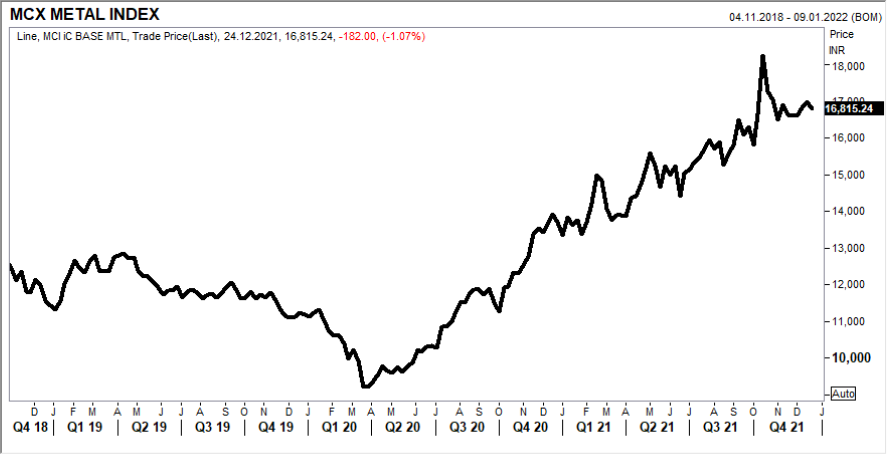

Base metals overshot the expectations last year on a combination of post pandemic supply constraints and rising demand. A fast recovery in China, the top consumer of base metals, disruption in mining operation, rise in transportation cost of bulk materials along with a rebound in fuel prices added to the cost of the materials, which contributed to the price rise.

Industrial metals soared massively in 2021 as manufacturing activities recovered quickly from pandemic crisis, mainly in China. Supply constrains due to disruptions in mining, spike in freight charges for the transportation of bulk materials, faster energy transition and ambitious infrastructure spending programs accelerated the price growth. Meanwhile, Chinese property market crisis and unexpected power rationing in the industrial sectors largely affected supply and demand of base metal segment. Copper on domestic futures platform (Multi Commodity Exchange) and London Metal Exchange rose to an all-time high of Rs. 812.60/kg and USD 10747/MT during Q2 2021, whereas red metal on Shanghai platform climbed to its highest level since mid- 2006 by claiming near 78990 CNY/MT. Nickel prices on MCX platform gained for the third year in a row, by testing above Rs. 1600/kg. Nickel on London platform hit the highest level since mid-2014 in the final quarter of 2021. Other metal peers Zinc, Lead and Aluminum scaled to all-time highs on MCX Platform mainly on the ground that smelters in China and Europe had to cut output owing to surging power costs.

Looking forward to 2022, the movement of major base metals are expected to be relatively better as the disruptions that we witnessed in supply chain is set to improve this year. However, tougher policies for the real estate markets in China to tackle debt problems in property sectors along with tightening environment policy remain a challenge for base metals. While hawkish stance of major central banks, stimulus tapering programs, rate hikes considering the rising inflationary pressure and a falloff in industrial activities due to higher prices may limit major price gains in base metals this year.

In the energy segment, US crude oil prices surged to more than USD 85/ barrel for the first time since 2014 in the previous year on improving demand due to global energy crunch. Meanwhile, another leading benchmark Brent crude tested near to 2018 highs by claiming more than USD 86/barrel last year. While expectations of gradual easing of production cuts from the Organization of the Petroleum Exporting Countries (OPEC) and its allies coupled with further demand concerns due to new virus variant ‘Omicron’ raised speculation that the global oil market is back to surplus and this impacted the price performance in late 2021. This year, price performance will be mostly driven by pandemic developments and OPEC+ decision on production outputs. The group has already decided to increase the production in January 2022, but with an expectation that the OPEC+ will act responsibly, like in previous years, when there is a surplus in the market.

On the other hand, natural gas prices gained last year to more than USD 6/MMBtu, the highest level since early 2014 on US platform as the inventory remained tight and there was a shortage of natural gas in Europe. Whereas strong exports to Asia and Europe further supported the US gas prices. However, prices failed to hold up most of the previous year’s gains owing to forecast for milder winter in US. Natural gas prices are likely to remain steady this year on high demand from Asia and Europe and delay in the commission of Russia’s Nord Stream 2 pipeline.

Although the possibility of further mobility restrictions is still on the horizon amid soaring cases of Omicron variant in the late 2021, there is a broad optimism that the economies may avert complete lockdowns. The progress in vaccination, containment of Omicron variant, economic growth and inflation in key economies and central bank policy path will remain as the key drivers of commodity prices in 2022.