By Manu Jacob and Krishnaprasad N B

As investors return to risky assets riding on the stimulus promises and vaccine rollouts, commodities started the year 2021 on a positive note. But looking forward, the year 2021 also has some challenges in the globally traded commodities. Commodity prices are essentially driven by the invisible hands in the economy, demand, and supply. Thus, it is improbable for a commodity’s price to cling to a single direction through its entire course. Considering the present scenario, most commodities have dusted off their losses from the Covid-19 pandemic, and some have already gained, rising above the previous year’s loss. At this point, investors may find themselves in a dilemma in choosing the further direction of their bets. Even amid successful trials of vaccination, rising infection rates from new variants of the Coivd-19 virus hang as a threat above the confidence that the pandemic will soon be contained. But, the investors seem to have reckoned that the worst is over.

Most of the positive responses from the investors at the year’s start were due to the rollout of vaccination and stimulus promises from the US under the new president. The US President Joe Biden offered a USD1.9 trillion stimulus package to support the economy. A quick supply of Covid-19 vaccination would effectively curb the infection rates helping the business activities to gradually revive their optimal productivity level. Prospects of US job market seem brighter this year with such financial aid in the economy.

The global economic growth is expected to recover in 2021. The performance of key economies from the second half of 2020 underscores this belief. The third quarterly growth of the US in 2020 marked a 33.4 percent growth. The Federal Reserve is expected to remain dovish through this year as it continues to aid the market with monetary aids such as bond purchases. Although the People’s Bank of China (PBOC) has shifted to a steadier stance since mid-2020, the central bank kept lower corporate lending rates to bring down borrowing costs to assist industries.

Precious metals to give steady but subdued performance in 2021

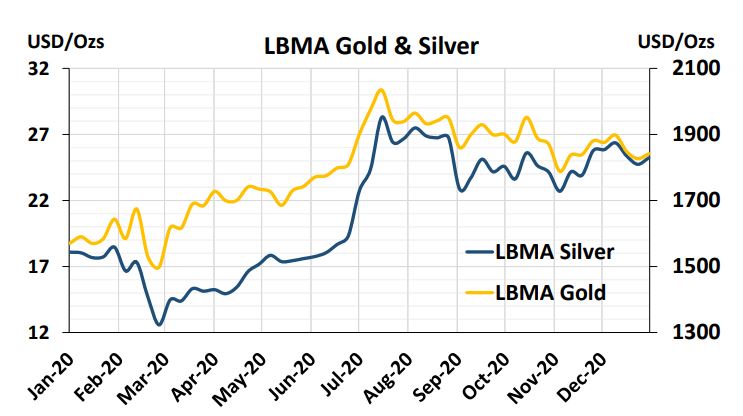

The LBMA spot gold ended the year 2020 with a 25 percent annual gain, as the investment demand drove the prices to all-time highs. Globally, the investment in gold-backed ETFs recorded annual net inflows of USD47.9 billion, the equivalent of 877 tonnes. It brought the total physical holdings to an all-time high of 3752 in tonnage. Although the gold-backed ETFs witnessed outflows during November and December of 2020, the total physical holdings still remain close to historic levels.

The improved appetite for riskier assets by the end of 2020 had weighed on the safe-haven appeal of gold. The bull run in the equity market and signs of economic recovery subdued the sentiments for precious metals. However, the steady investment demand for gold as a strategic asset amid lingering uncertainties and recovery of consumer demand are expected to support its prices this year. In addition, the performance of yellow metal may be boosted further by the ultra-low interest rate that would remove the opportunity cost of investing in gold. Any further deterioration in economic conditions could slow the recovery of consumer demand for gold. But, it would attract investment demand for safe-haven gold, offsetting low consumption.

The LBMA spot silver posted a 47 percent annual gain in 2020. The consumption and industrial demand for silver have weakened last year, while the investment demand had boosted the prices. Relatively lower prices among the precious metals bolstered investment demand for silver amid growing economic uncertainties. The iShares Silver Trust with the largest silver-backed ETFs had net inflows of 54 percent in 2020 and added up to a total of 15839 tonnes or 558.71 million troy ounces. Steady investment demand and relatively higher consumption demand may support the prices throughout this year. Apart from that, improvement in manufacturing activities would support the industrial demand for white metal in 2021.

Crude oil may gain pace on recovery in fuel demand and on adherence of OPEC+ supply cut

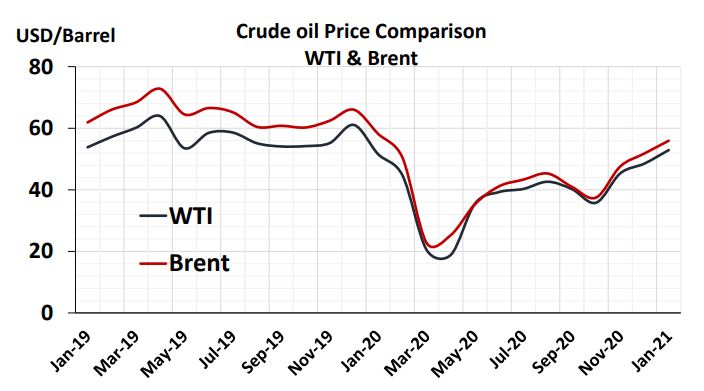

The year 2021 would be rather contributory for the ongoing recovery path of crude oil prices after Covid-19 led demand destruction and subsequent fall in the price of crude oil. Worldwide fuel consumption declined significantly on mobility restrictions due to the spread of the pandemic. Prices gradually improved after timely action from major oil cartel OPEC+ alliance to cut production and viability of multiple Covid-19 vaccines. Recovery in fuel demand after the reopening of economies was commendable. Global crude oil demand was up by 15 million barrels per day. As per Energy Information Administration (EIA), global oil consumption increased by 6 percent from 2020 levels to reach an average of 97.8 million bpd in 2021 and by an additional 3 percent in 2022. The price-performance of crude oil this year largely depends on the effectiveness of mass vaccination which may determine the consumption behaviour, while duration and adherence of production policy of OPEC and its allies along with US oil production levels could influence the price sentiments.

Natural gas

A muted performance is likely to be witnessed on natural gas this year. The largest natural gas-consuming area in the US is from the electric power sector and it is estimated to be an average of 28.1 billion cubic feet per day in 2021. Meanwhile, higher prices for natural gas for power generation and the rising trend of electricity generation from renewable energy may hold up major gains in 2021. While the trend of increasing levels of US exports of liquefied natural gas and weather patterns may limit a major corrective fall.

Base metals to gain from recovery in industrial demand, stimulus measures and vaccine rollouts

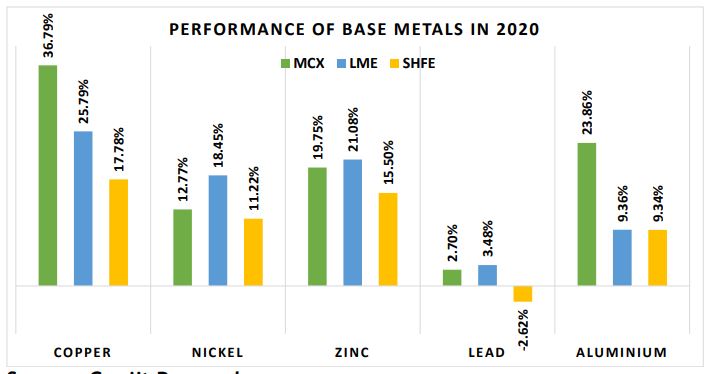

Base metals seem to continue their momentum this year as well, mainly on improving global demand, which was once faded heavily by the impact of Covid-19 led crisis. However, by the second quarter of last year, the market witnessed rallies on industrial metals stoked by strong demand from top consumer and the second-biggest economy China. Enormous funding measures from the Chinese administration helped in the V-shape recovery in China’s manufacturing sector. New infrastructure plans and industrial policies like Made in China 2025 and China Standards 2035 plans will possibly increase the demand for metals. However, in late 2021, there is a possibility of a gradual rollback of policy measures by China which has spooked liquidity measures during peak pandemic crisis, may temporarily halt major gains which we observed in 2020. However, growing world economic conditions on massive vaccinations and additional US fiscal measures and easing trade tension under new regime might improve the market condition.

The red metal copper is likely to advance further on low inventories and tightening supplies in Chile and Peru along with speculation of further Chinese industrial demand. Furthermore, the new additions to smelter capacity in China and demand from the country’s new blending operations in 2021 would support copper prices. On a major trading platform, copper was the top performer among base metals in 2020, where Shanghai copper even gained by 17.78 percent and its controlled warehouse stocks drop to more than 9 year low.

Chinese stainless steel demand and raw material shortage may extend nickel gains, added to that, the expectation of increasing demand from the battery sector is also expected to uphold the price sentiments. Strong galvanizing demand from steel producers and supply worries from major zinc mining nations are expected to support zinc prices this year. In the meantime, improved downstream demand from lead-acid battery makers would support lead prices through this year.

Aluminium demand outlook remains positive for 2021, mainly demand drive from China’s primary aluminium smelters. On the other hand, oversupply concerns are likely to weigh on the prices, limiting major gains. China’s aluminium production in 2020 rose 4.9 percent from the previous year to a record 37.08 million tonnes.