In the current market situation, even the most optimistic of investors will think twice about investing. Such has been the carnage that new MF investors and SIP investors, not used to such deviations in their portfolio returns, have seen their investment amounts erode at a fast rate. With the benchmark indices down by around 35% (as on 23.03.2020), even the bluechips of the Indian stock market have seen huge market cap erosion. The destruction in market cap is evident from table 1, which details the Top 10 companies, based on market cap as on 31.12.2019, and their current position (as on 23.03.2020).

In the last three months (till 23.03.2020) we have seen an erosion of close to Rs.16 lakh crores of market value for just the Top 10. SBI has dropped out of the Top 10 to the no.11 position. TCS is now the most valued company. Bharti Airtel has moved to no.7 position. Most of the companies have dropped between 30 – 40%. Only HUL has withstood the negativity, down by 3%, in terms of market cap. Now these are the bluechips, companies that you know, with the products / services that you use on a daily basis. The drop in stock prices, for most companies, is linked to shocks related mainly to Covid-19 and stressed assets uncertainty for Banks etc., and not because of their business fundamentals. Long term investors need to keep that in mind.

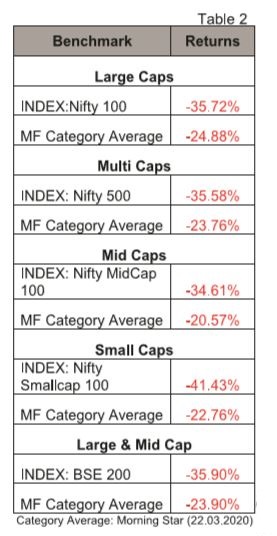

The table below shows the comparative returns of various MF categories against the benchmarked indices, keeping in mind the investment mandate of the respective categories.

We can see that the difference between benchmarked indices and the category average is much higher when it comes to Small Caps and, to an extent, Mid Caps also. Please note that this is only for the Growth option in Mutual Funds and have not included returns for the Dividend option. When you drill down you also see that the difference between Top performer and Bottom Performer, in each category, is also wide. For the Small Cap category the difference in returns between the Best and the worst performing fund is close to 20%, which again underlines the importance of consulting your advisor and choosing the best fund based on your investment criteria.

Equity investments have always suffered whenever a global crisis hit and a Risk-off attitude persists. The SARS epidemic provides us the closest comparison of a global health crisis, and the markets recovered from this scare in just 6-8 months.But Covid-19 is different from other epidemics in terms of the ease of spread and the number of infected people. Its mortality rate is only 4.3% as compared to SARS mortality rate of 10% and MERS mortality rate of 30%. So although the number of deaths in percentage terms compared to the number of infected cases may be low, the absolute number of deaths from this virus has been much higher. As such this has been one of the deadliest viruses in recent history, in terms of deaths and definitely in terms of its economic impact. The Indian markets, in sync with global markets, have also reacted fiercely because of this fear. A major part has been played by FIIs, who are seeking out safer assets and have been net sellers to the tune of Rs.52000 crores in Equity and Rs.50000 crores in Debt (as on 23.03.2020). But unlike the other scenarios in which the markets have been impacted, like the 2008 global recession period, here we have a point of recovery. Any news regarding the Covid-19, whether it is about the containment of the virus or announcement of a vaccine, will definitely be a positive trigger for the global markets on the upside.Post the virus containment, the recovery mayinitially be fast, but with the global economic slowdown, its sustenance will depend on the monetary actions of Central banks working in tandem with their respective government to bring economic activity back on track.

So the current market scenario may seem to be extremely scary, but the stock markets have outlived such scares and come out stronger and better than before. In spite of the huge volatility there are still opportunities for the long term investors. Existing investors must consider this as an opportunity to rebalance their Equity portfolio and build it up for the long term. Although we are unsure about whether it is the right time for bottom fishing of stocks, please note that there are a lot of quality stocks available at lower valuations and are ideal for “accumulating” for the long term. For novice investors, we would advice your Equity portfolio to reflect your Large Cap stock exposures since these companies are easily researchable and information is available. The Mid and Small cap exposure, which is inherently more risky and more difficult to analyse from an individual perspective must be taken care of by your Mutual Fund / SIP investments and its fund managers. Even for a Mutual fund its best to consult an advisor because the difference in returns between the top quartile and bottom quartile is wide. Although it may seem difficult with the markets at these levels, existing SIPs in Equity and MF should continue because you are buying into these low levels. The current scenario is a matter of “When” the markets will recover, not “If”. Stay Safe… This too shall pass.