For parents, providing top notch higher education to their children is an important aspiration and many are willing to sacrifice a lot to achieve this dream. But this calls for a great deal of financial planning to meet the future cost close to actual. Overall cost of education includes the fee and other maintenance costs such as accommodation, food, travel – both personal and academic, etc. And those would be incurred in a phased manner, rather than one time expence. Investors should make note of these incidental associated costs while estimating the future cost. Hence, plan your investments into instruments in such a way that it matches with your future cash flow requirements in terms of quantum and the phases in which it is required. Also be careful not to stop or withdraw the investments in between, ahead of the goal period.

For parents, providing top notch higher education to their children is an important aspiration and many are willing to sacrifice a lot to achieve this dream. But this calls for a great deal of financial planning to meet the future cost close to actual. Overall cost of education includes the fee and other maintenance costs such as accommodation, food, travel – both personal and academic, etc. And those would be incurred in a phased manner, rather than one time expence. Investors should make note of these incidental associated costs while estimating the future cost. Hence, plan your investments into instruments in such a way that it matches with your future cash flow requirements in terms of quantum and the phases in which it is required. Also be careful not to stop or withdraw the investments in between, ahead of the goal period.

It is estimated that in India, the primary and secondary education inflation is around 12% and that of Higher education is between 16% – 20% (depending on the institution) Equities have the track record of delivering returns beyond 14% – 15% over a longer time period. Systematic Investment Plans in Mutual Funds is the best way of investing in Equity Market, as they play in favour of Value Investing in both bull and bear markets, with compounding and cost averaging, respectively. For first timers, SIP is an investment method in which investors choose to invest a fixed sum every month on a pre-selected date in a mutual fund scheme, and for a pre-defined period (which ideally should align with number of years to reach the goal). Since investment happens every month, it eliminates the risk of timing the market. When the price of the selected mutual fund unit, technically called as Net Asset Value (NAV), goes down due to the drop in market value of portfolio, investor buys more units. When the price (NAV) goes up, investor buys lesser units, thereby achieving a better Average Purchase Price over the investment tenure.

Top-up definitely helps to reach the goal requirement quite comfortably and with surplus cushion post meeting the cost.

Data shows that in India, over a 15 year period, the average SIP returns delivered across 111 Mutual Fund schemes is around 12.9%.

Parents can plan well in advance for their children’s education by calculating the present average cost of education, the expected future cost (at certain inflation rate) and start investing towards that.

Once parents have planned and calculated the future cost they are usually faced with the question whether to invest in dedicated Children’s fund or a diversified Equity fund. The difference between an exclusive children’s plan and a normal equity diversified fund is, on a comparable investment objective basis, they are more or less same in terms of the investment style, except for the individual portfolio that is held in a scheme and its performance. That apart, Children’s funds are structured in such a way that it hinders early exit ahead of certain age limit of the beneficiary (child). Hence, if the investor-parents are self-disciplined, then an equity diversified fund could be equally fine for building future goal corpus.

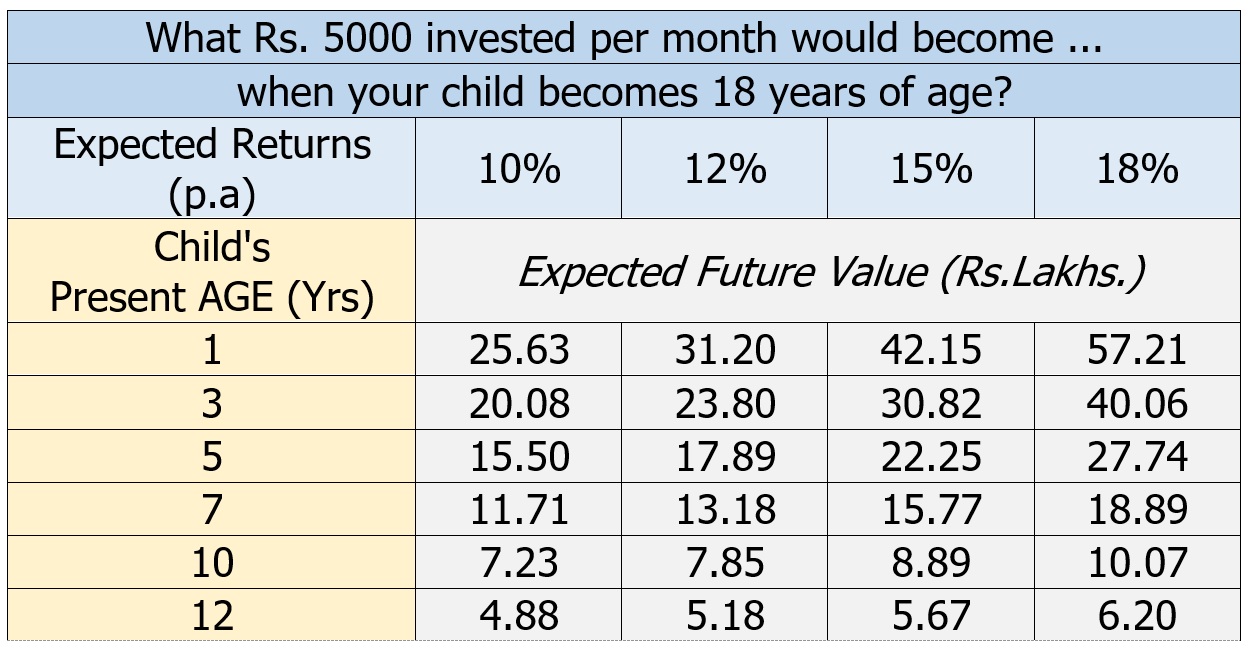

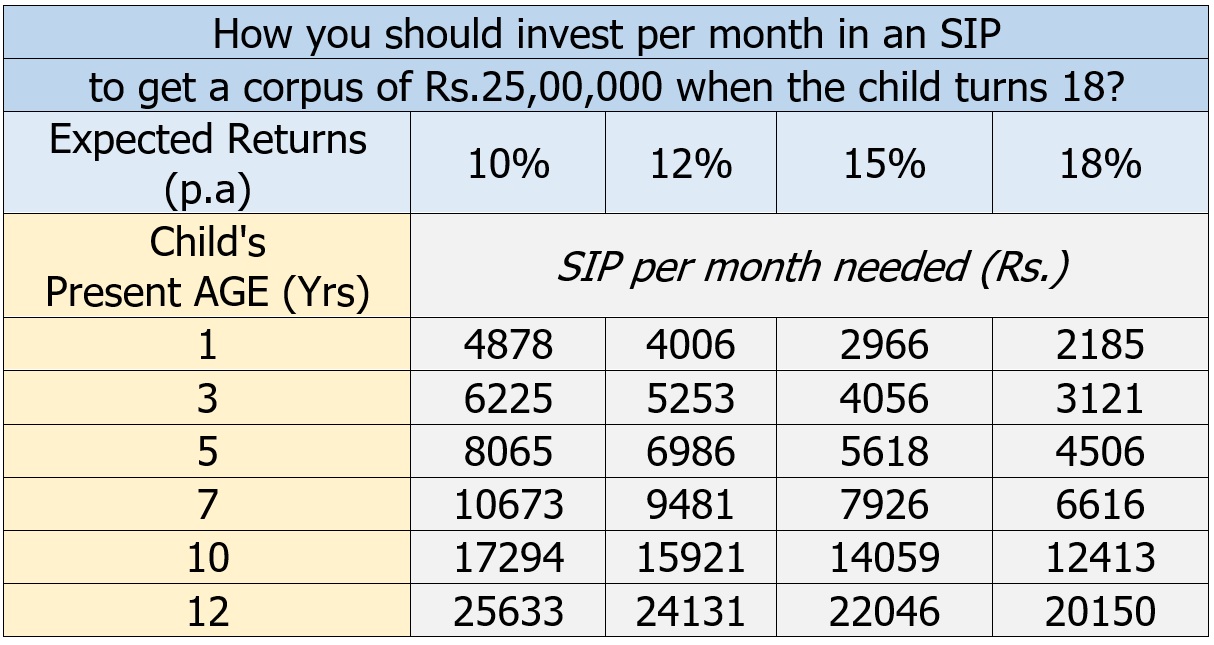

The advantage of starting early is that, one needs to invest a very nominal amount, than what is required, if it is delayed by say 3 or 5 years.

Arithmetic shows that to reach a corpus of Rs. 25,00,000 in 17 years, one needs to invest Rs. 4,000 per month in an investment that grows at 12% pa. The monthly investment requirement goes up by 31%, if the same is delayed by 2 years.

Investment in mutual funds through SIPs is the best strategy towards securing child’s future.

First appeared in Outlook Money.

I need to start for my children

age 1.5years and 2.5 years

0506623184

It is a wise decision to start early in the name of your children for their secured future. As you are looking for a long term investment for your children it is advisable to start SIPs in the following schemes from Multicap and Large & Midcap category . The selected funds are 5 star rated and are included in our recommendation list.

1. Kotak Standard Multicap Fund(G)

2. SBI Magnum Multicap Fund-Reg(G)

3. Mirae Asset Emerging Bluechip-Reg(G)

4. SBI Magnum Multicap Fund-Reg(G)