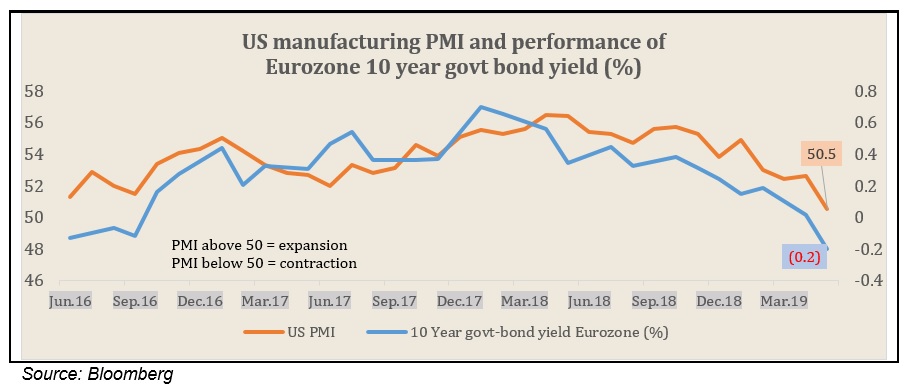

Post the overwhelming result of the litmus test (election), domestic equity market has shifted its focus to the gloomy reality of domestic and international economy. Since a good portion of the political stability has been factored in the market and economic data was weak, the market turned cautious. The economy needs stimulus and central banks across the world are rushing to provide support to their respective economies. RBI has cut its policy rate three times in its last three policy meets. FED has changed its attitude on interest rate hikes to neutral and is likely to turn accommodative in the latter part of the year. EU is looking for new ways to push liquidity in the second wave of quantitative easing by cutting interest rate in spite of it being so low. The current 10 year yield of Euro area is at -0.2%. EU is also looking at new round of bond purchases.

Post the overwhelming result of the litmus test (election), domestic equity market has shifted its focus to the gloomy reality of domestic and international economy. Since a good portion of the political stability has been factored in the market and economic data was weak, the market turned cautious. The economy needs stimulus and central banks across the world are rushing to provide support to their respective economies. RBI has cut its policy rate three times in its last three policy meets. FED has changed its attitude on interest rate hikes to neutral and is likely to turn accommodative in the latter part of the year. EU is looking for new ways to push liquidity in the second wave of quantitative easing by cutting interest rate in spite of it being so low. The current 10 year yield of Euro area is at -0.2%. EU is also looking at new round of bond purchases.

Slowdown in World Economy

In India the pre-election rally was positive with key indices like Nifty50 and Nifty Small caps registering a 10% return in three months. Immediately after the result, the broad market settled for further gains in a couple of weeks which couldn’t be sustained due to economic hiccups.

Government is expected to address this issue by providing additional support to the economy through fiscal policy. The RBI is providing monetary stimulus through rate cuts. There are high expectations from the upcoming Union Budget where the main agenda is job creation, government spending, infrastructure, manufacturing, exports and tax reduction. On the other hand, RBI will focus on correcting the country’s financial situation by increasing the availability of liquidity at lower credit cost while higher foreign inflows will push the market to higher level in the medium-term. Given the growth agenda of the government, the sectors to do well would be financial, industrial, infrastructure and cement.

India is equipped to survive and grow post this setback

When we look at the current financial news and developments in the domestic and global economy, we come across a lot of negative facts and figures that scare us from investing in the equity market. In the global market, we hear about a deep slowdown in the world economy with a possibility of recession in the coming years. As a result, the bond yields are falling to new lows (example, US 10-year yield is at a new 52 week low of 2.05% from a high of 3.25%). The new devil, “trade-war”, is catching the attention of investors and giving out the fear of ruining the benefits of globalization, which is the key basis of today’s developed world economy. In the last one year, the equity performance of important countries like China, South Africa, Mexico, South Korea and Europe was bad with an average return of -11%. While the US market has been flattish with volatility due to trade tensions and slowdown in economy.

At the same time, in the domestic economy we see rural distress, weakest GDP growth in the last five years, at 5.8% for Q4FY19, the 2nd driest pre-monsoon spell in the last 65 years (IMD data during March, April and May), lack of liquidity in banking system, low earnings growth and the most expensive valuation in the last 10 years with trading P/E of 25.5x on main benchmark like Nifty50.

Overall, the world’s wealth has consolidated during the year. The investment patterns got choosier by turning cautious and investing in risk-averse assets. The investment hierarchy was towards debt/bonds, stable currencies, oil and gold. A similar pattern is visible in India where S&P BSE Bond Index is giving a return of 12.8%, Gold with 5%, and INR appreciating by 6% from 52-week low about six months back. While in the case of equity, the approach has been country specific with focus on stable sectors and stocks with a top to bottom approach. In India, the best three performers with average +20% YoY are IT, finance and consumer durables while worst are auto, metals and telecom, while mid and small caps are down by 7 to 18%.

In spite of all the cloudiness, the equity performance of India has been positive with a return of 10% in the last one year till 18th June 2019. The other two countries doing well are Brazil and Russia due to an uptick in crude and soft commodities prices. Despite gold being a safe haven asset, assumed to provide safety during such troubled times,it has provided only a muted positive return in the domestic and international market.

Though the undercurrent of the economy has been fragile, the market always had a hope that the economy will benefit from the previous reforms while new reforms will be initiated to accelerate growth and increase private investment. Hence, the market was always on premium valuation. The world views India as an upcoming economy, which is led by domestic growth, isolating itself from the ongoing trade tension and might have possible gains. India is likely to benefit from the US-China trade war by exporting more to both the countries.It may open opportunities for India to boost exports of over 350 products, as per a study by the ministry of commerce and industry. Around 151 domestic products including diesel, X-ray tubes and certain chemicals have an outright advantage to replace the US exports to China. Similarly, 203 Indian goods like rubber and graphite electrodes have the advantage to replace Chinese exports to the US. Increasing exports would help India narrow the widening trade deficit with China, which stood at USD 50.12 billion during April-February 2018-19, the study noted.

In the near to medium term, given the limited headroom in valuation, we do not anticipate big growth in the main indices. But at the same time, we have a positive view on mid and small caps led by higher investments from FIIs and mutual funds in the coming period. The short-term headwind in the domestic market could be based on the high expectation from the new government to support the economy while the actual measures are yet to be initiated. The government will have to follow fiscal prudence given the shortfall in financial revenue. It will be a challenge to match this expectation but government may have to stretch the fiscal target in the short-term by higher government spending, which is the need of the hour.

We had a one-year target of 12,000 for Nifty50 on 31st of March 2019 which we have increased to 12,700 post the Q4 results and election outcome, a marginal gain of 7% from Nifty50 of 11,870 date 15th June 2019. Q4 results were mixed, but it was understood that a good portion of these issues are one-time in nature and growth will propel from H2FY20. At the same time outlook has improved for FY20 led by likely revival in H2FY20. We are maintaining positive earnings growth for FY20 and FY21 of 17.5% and 15% growth respectively. We have increased the P/E valuation from 17x to 17.5x given the better stability and progressive outlook.

We advise our clients to increase their exposure in equity with a larger pie of mid and small caps, in a range of 20% to 40% as per their risk-taking appetite for long-term gains.Large caps may underperform since they are currently valued above the long-term average. Sectors which are investable in large caps are private banks, rural banking, branded NBFCs and consumer durables, retail, aviation and chemicals.