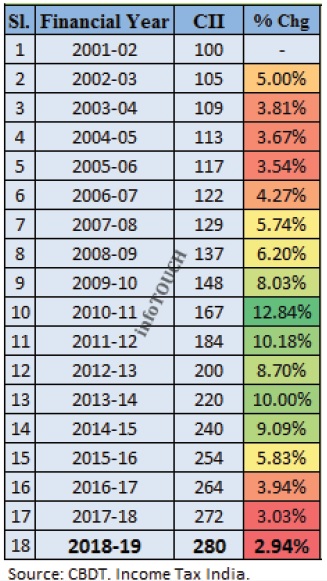

Cost Inflation Index (CII), is a reflection of price changes between two periods and denotes the average inflation that prevailed during that time. Central Board of Direct Taxes maintains and publishes CII on an annual basis.

Cost Inflation Index (CII), is a reflection of price changes between two periods and denotes the average inflation that prevailed during that time. Central Board of Direct Taxes maintains and publishes CII on an annual basis.

How is CII calculated? Section 48 of Income Tax Act reads, ‘CII is an Index having regard to seventy-five percent of average rise in the Consumer Price Index (urban) for the immediately preceding previous year to such previous year.’ The rate is then multiplied with the CII of previous year, to arrive at the CII for current year (rounded off). This is officially notified by the government.

What is Indexation? Indexation refers to the process of adjusting the purchase price of an asset to the inflation rate that prevailed during the period for which it was held. This inflation-adjusted cost is considered as the purchase price while computing the gains arising from the sale of the asset from the taxation perspective. In other words the gains are adjusted for inflation first before computing the tax. This helps in reducing the tax outgo and this is of significance especially during inflationary periods.

It is calculated thus: Indexed cost = Cost of Purchase OR Investment Value * (Sell Year CII / Buy Year CII)

Change in the Base Year: Initially the base year of CII was 1981-82. In the Budget 2017 finance ministry proposed to amend the Base Year of CII to 2001-02. For capital assets, eligible for indexation, acquired prior to 2001, the higher of Fair Market Value as on 01-04-2001 or the actual cost shall be taken as the purchase price to avail the indexation benefits.

Application: Certain notified assets are eligible for indexation while computing the capital gains. Here we will see the effective use of CII and Indexation benefits in Mutual Funds.

Currently Non-Equity Oriented Schemes like Debt Funds, Capital Protection Funds, Hybrid Funds, Dual Advantage Funds, Multiple Yield Funds, Fixed Maturity Plans, Gold Funds, etc are eligible for Indexation.

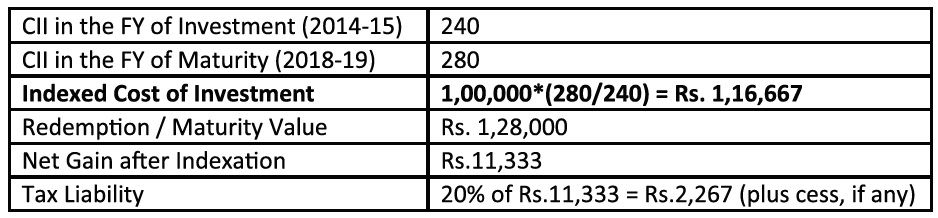

Let’s assume, that an Individual has invested Rs. 1,00,000 on 01.03.2015, in a scheme that is eligible for Indexation (Non-Equity Fund). She redeemed after 36 Months (say on 31.08.2018) at Rs. 1,28,000. Net Capital Gains (without Indexation) is Rs. 28,000 and this is Long Term Capital Gains since the investment was held for more than 36 months (1279 Days). Calculation goes thus:

Alternatively, without indexation, the tax would be charged on the total gains i.e., Rs. 28,000 and at the individual’s respective tax slabs. This means an assesse at 30% tax bracket would have to pay a tax of around Rs.8,400 and an assesse at 20% Tax Slab would have to pay around Rs. 5,600 (without cess). This is where Debt Mutual Funds score over other Investment options that do not have Indexation benefits (like FDs, where the Taxation is on the whole Gains, as per the Individual’s Marginal Tax Slab).

It must be noted here that in the last four financial years, the CII has highly moderated due to a drop in the average CPI inflation. The average CII rise from FY 2016 to FY 2019 is 3.94% versus 9.49% from FY 2012 to FY 2015, on the new series. Non-Equity Mutual Fund Investors were able to reduce on the tax out go, even on the low inflationary years by availing the Indexation benefits. During high inflation years, the tax advantages could be more (as CII would be higher), sometimes resulting in NIL outgo. This is something all the traditional Investors parking funds in FDs should be aware of. Debt Mutual Funds have the potential to maximize the net yield and returns by way of indexation benefits, and hence lesser tax outgo.

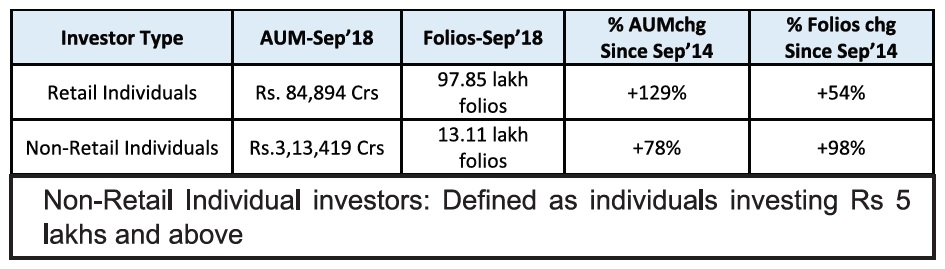

According to the data compiled from AMFI, Retail and Non-Retail Individual Investor participation in Debt-oriented Mutual Funds between 2014 till 2018, the period when interest rates dropped and went up is as follows:

Cost Inflation Index Table for reference – New Series: