By Antu Eapen Thomas

By Antu Eapen Thomas

The global financial crisis of 2008 almost completely stopped the lending mechanism of the world’s banking system. However, this crunch was wisely managed by the US-FED by releasing additional funds at zero cost and nationalizing some big financial institutions. Fed was able to undertake such aggressive measures as they had the flexibility and power to print new dollars. This strategy continued under Quantitative Easing, in the form of pumping funds into the financial market and banks. A similar measure was undertaken in other developed nations of Europe and Japan.

However, in spite of the corrective actions being undertaken at quick pace, this crisis impacted the economic growth and productivity of those economies. Though the direct impact of this global crisis was limited for developing economies like India, in reality, it impacted the risk taking ability, capacity utilization and industrial production over the next couple of years.

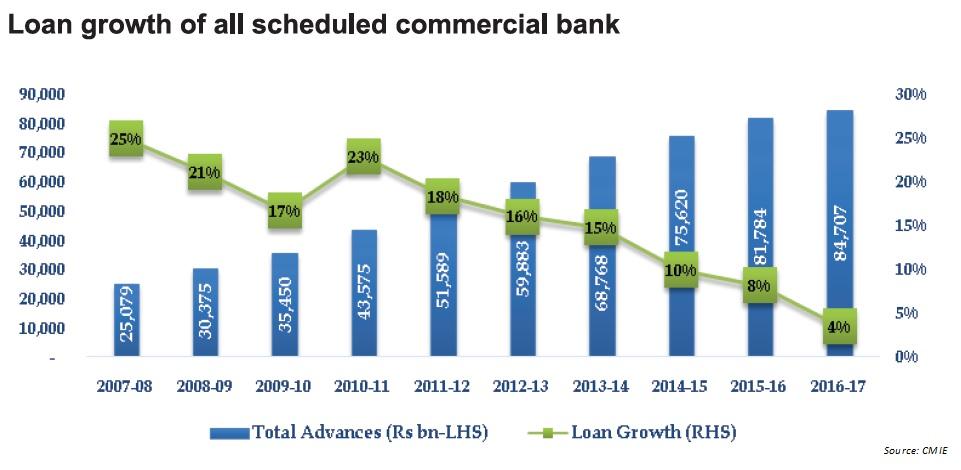

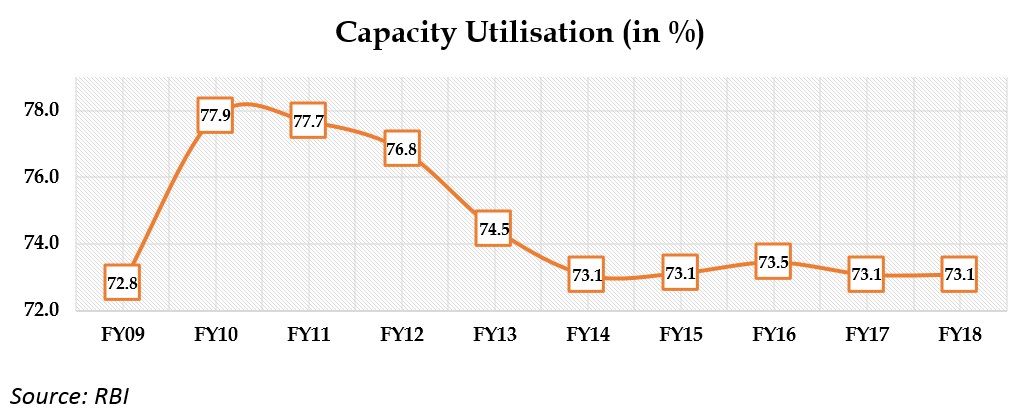

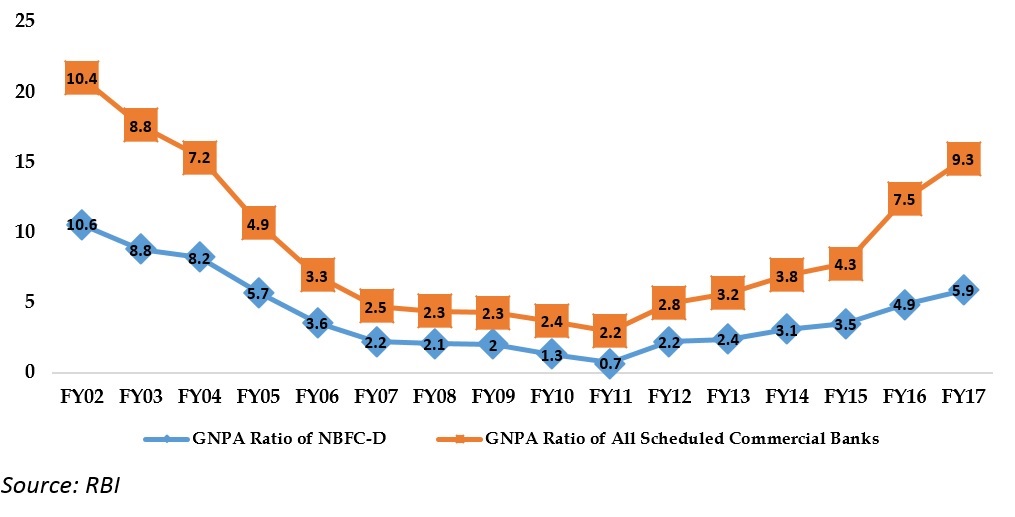

During FY08-11 total lending by all scheduled commercial banks increased at a CAGR of 20% to Rs 43,57,500 cr. Increased competition in the banking sector further led to lending without due diligence to the quality of assets. However, IIP (Index of Industrial Production) weakened from high single digit in the year 2010 to 2.7% in 2011 and as a result, the stress in the banking system increased after FY11. Correspondingly, banks’ GNPA (Gross Non-Performing Assets) surged to 2.8% in FY12 from 2.2% in FY11. This, in turn, negatively impacted demand in several key industrial segments as there was a liquidity crunch across the sector denting capacity utilization. Overall industrial capacity utilization declined from 77.7% during FY11 to 73% for FY14.

Lending and GDP growth

Indian banks resorted to aggressive lending practices during the boom period (from FY04 to mid FY09). Consequently, the corporate sector had excessive leverage to finance aggressive capacity addition. Also, it was widely perceived that the impact of the global financial crisis on the Indian economy was minimal. Consequently, the banks continued to lend aggressively to capital-intensive sectors during FY08-11. As a result there was a significant investment capacity expansion across the infrastructure sector. Further, GDP has also improved to 8.9% in FY11 albeit a fall in FY09 to 6.9%.

On the other hand, post FY11, poor capital position of PSU banks due to NPA issues and certain PSU banks that fell under PCA contributed to slower credit growth. In FY17, the bank’s loan growth further suffered due to demonetization and GST related disruptions.

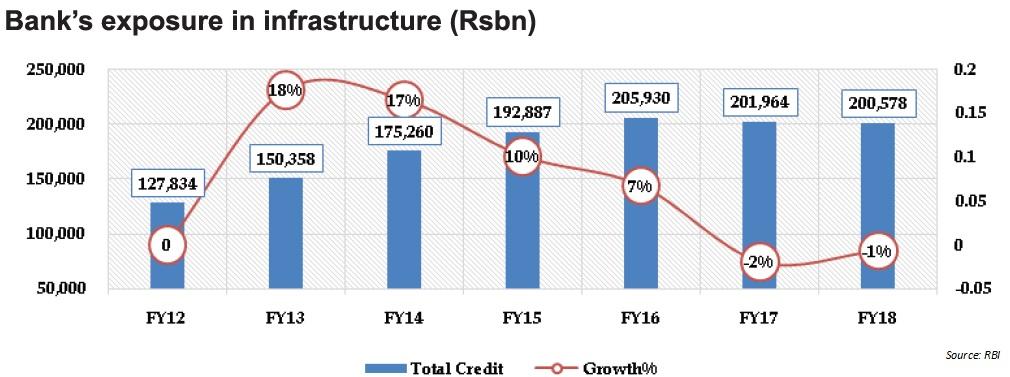

Declining credit growth in infrastructure…

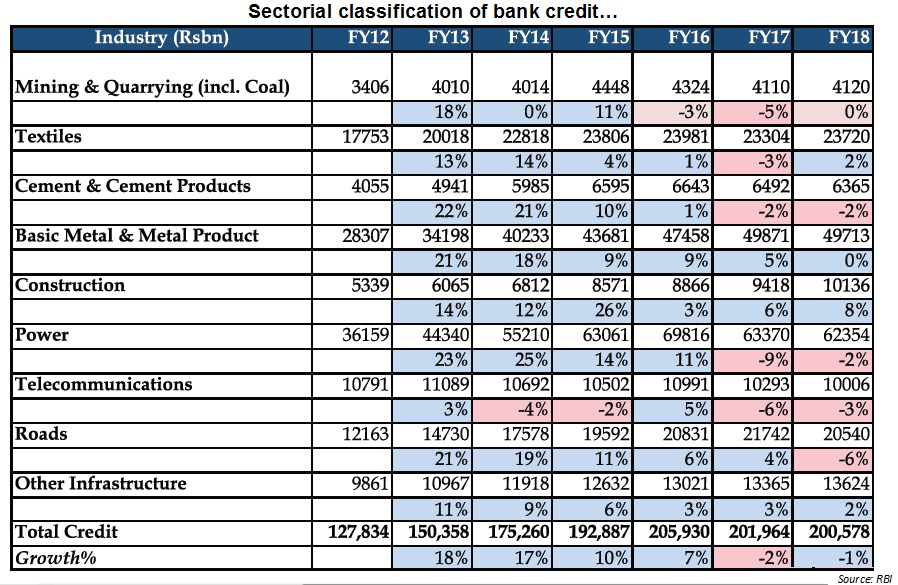

Infrastructure is the growth driver of an economy while bank credit is inevitable for the growth of the economy. The credit growth in the sector has not improved post FY14 as delays in land acquisition, resettlement and rehabilitation issues, environmental clearances, tie-up of project financing, non-availability of fuel for power generation and lack of infrastructure support, stalled many projects. This has resulted in a sharp fall in bank credit to infrastructure. During FY15, growth has declined to 10% against 17% in the previous year. While in FY18, growth has come down to negative 1%.

- Sectors like mining, textile, cement, power and telecom dragged into negative growth post FY16.

- Increased competition in tariff rates, high debt to equity and consolidation in telecom sector impacted the growth.

- Poor capacity expansion in cement industry dented the credit growth.

- Delay in land acquisition, regulatory issues and working capital issues impacted the road and construction sector.

- Power sector witnessed distress in the last few years and subdued industrial demand for power due to weak growth in core sectors, non-availability and increase in cost of resources.

Capacity utilization declining…

As a result of increase in stalled projects, shortage of capital and higher interest rates, capacity utilization of manufacturing sector got adversely impacted. Utilization declined to 73.1% in FY14 from a high of 78% in FY10. Further, there has been a decline in GDP growth from 8.9% in FY11 to 4.8% in FY14.

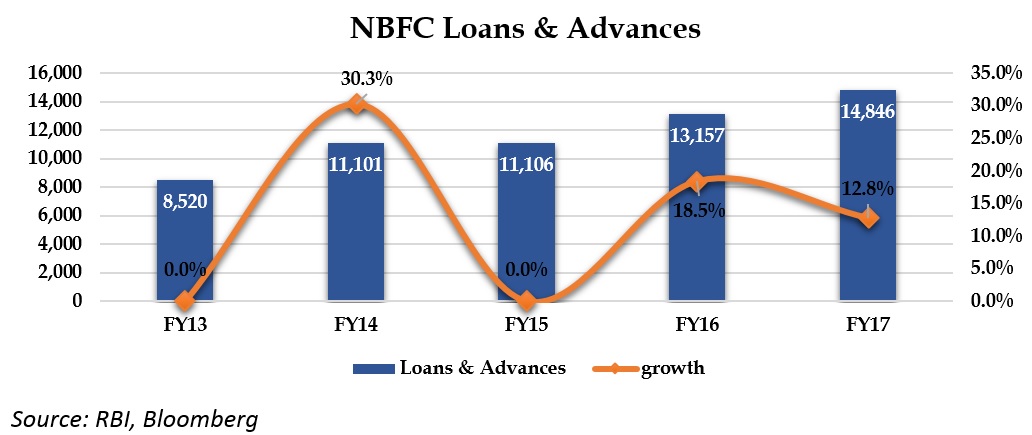

Stress in banks asset provided space for NBFCs togrow

After that we witnessed a slowdown in lending by all scheduled commercial banks due to bad loans and high regulation from RBI. This gave space for Non Banking Financial Company’s (NBFC)- to grow supported by healthy liquidity and greater regulatory flexibility. Over the past few years, NBFCs credit was growing at 15% while that of banks at 8-9%. Now as rates rise and liquidity tightens, we expect NBFC’s lending to slow down. This in turn would hurt the flow of funds to some segments of the economy.

Gross Non-performing Assets (GNPA) of Banks and NBFCs significantly increased

Financial institutions tend to over-stretch their lending portfolio during economic booms and restrict the same during economic downturns. It has been argued that an expansion in credit growth is associated with the deterioration in asset quality because when banks and NBFCs over- expand their lending, they tend to lower their credit standards. This translates into greater slippages in asset quality at matured stages of the credit cycle. Additionally, tougher stressed assets framework put in place by RBI significantly increased Non-performing asset (NPA).

IL&FS saga pours fuel on fire

The Reserve Bank of India had expressed concerns about the operations of Infrastructure Leasing and Financial Services Limited (IL&FS) Financial Services in its report dated three years ago pointing out that the net owned funds of the finance company had been wiped out and that it was over-leveraged. Currently, IL&FS group has over Rs 90,000cr debt and has defaulted on five debt issues so far. The first default was on August 27, 2018 on a commercial paper issued by subsidiary IL&FS Financial Services. In addition, IL&FS has defaulted in repaying a short-term loan of Rs 1,000 cr to SIDBI. On credit quality, IL&FS group’s debt securities looked good till a month and a half ago with a A1+, but suddenly got downgraded, to D ratings on 17th September 2018.

Lending to slow down if banks fail to take new measures to contain NPA

PSUBs currently stand with a stressed loan book and crunch in liquidity as a consequence of continued lending at the time of this slowdown. But in reality, the expected revival in the core sector didn’t happen and actual productivity suffered with the loan book weakening further.

Initially private banks were not much affected but increased competition that followed led them to be a part of the saga. Consequently, Private Banks’ NPAs surged significantly during the last five years and the total GNPA of all scheduled commercial banks rose to 9.3 percent (as on FY17). As banks were mounted with bad loans and came under strict regulations, it provided space for NBFCs to capture the incremental loan growth that happened during the last two years. However, they also got bitten by the crisis, as evidenced by their weak asset quality (GNPA of 5.9 percent in FY17).

All the sectors of an economy are largely dependent on bank credit to finance their investments. In fact, growth of an economy is closely related to the growth of bank credits. But the growth in bank credit cannot improve unless banks take new measures to contain NPAs.