• ICICI Bank’s standalone interest income rose 3.0% YoY to Rs. 41,758cr in Q2FY26, primarily driven by a 10.3% YoY increase in total advances.

• Net interest margin (NIM) expanded 3 bps YoY to 4.3%, influenced by lower de-posit rates and cost of borrowing, combined with the beneficial effects of repricing external benchmark-linked loans and investments.

• Reported PAT rose 5.2% YoY to Rs. 12,359cr owing to decreased provisions and contingencies in Q2FY26 (-25.9% YoY, -49.6% QoQ). Provisions declined sequentially because of seasonal trends in the Kisan Credit Card (KCC) business and the overall healthy asset quality across segments.

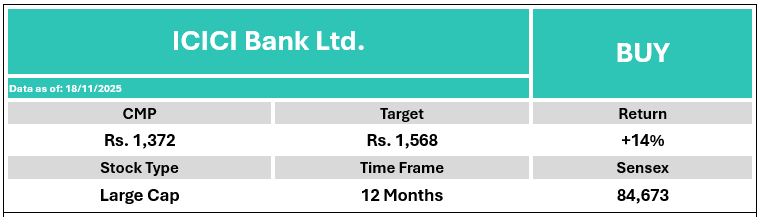

ICICI Bank delivered a satisfactory performance in Q2FY26 supported by healthy loan growth and resilient margin, amid a competitive environment. The bank highlighted continued traction across retail and business banking segments. Asset quality was stable, with prudent provisioning and strong capital buffers ensuring balance-sheet resilience. Its strategic focus on risk-calibrated profitable growth positions the bank for long-term scalability. Stable asset quality, better unsecured cohort and smother regulatory transitions are expected to strengthen future performance. Hence, we upgrade our rating on stock from HOLD to BUY, based on sum-of-the-parts (SOTP) valuation, with a revised target price of Rs 1,568.