Global economy is passing through an unprecedented phase. In an uncertain economic scenario, there is a general tendency among the households to spend less and save more. And, it is imperative for the households to know which asset class yields the best returns, providing a cushion against the uncertain future income. More importantly, it is important to understand which asset class yielded the best inflation-adjusted returns.

By definition, inflation refers to the general rise in the price level in an economy. Increase in inflation leads to a fall in the purchasing power of currency as the commodities and prices get dearer. In simple words, we would be able to purchase only fewer items for the same money. Thus, a rising inflation rate would lead to a corresponding increase in the cost of living. Hence, it is important from an investor’s point of view to have a portfolio of assets that provides the best hedge against inflation.

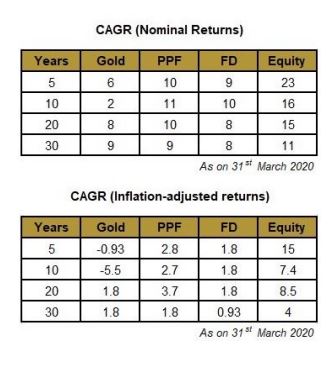

Here, we are considering the four popular asset classes in India- gold, fixed deposits (FD), Public Provident Fund (PPF), and equity. Starting from 31st March 1991, the analysis is carried out for a period of 5 years, 10 years, 20 years, and 30 years.

Gold

Though 2020 is a phenomenal year for gold, it could be seen that the long-term performance of gold is not quite encouraging. Gold failed to beat inflation over a 5-year and 10-year period, but delivered positive returns over the long period with a thin margin. Presently, higher demand for gold is mainly due to the uncertain economic scenario prevailing in the global economy. Investors are looking for safe bets to protect themselves from the volatile environment. In this background, there is a higher demand for gold, considered to be a safe haven, which is reflected in its higher prices.

Public Provident Fund (PPF)

PPF managed to generate positive inflation-adjusted returns over the years. Performance over the 20-year period has been quite good, generating a positive return of 3.7 percent. However, for the 30-year period, inflation-adjusted returns declined to 1.8 percent. The interest rate on PPF are linked to the 10-year G-sec yield. Presently, 10-year G-sec yield is moving downwards. For instance, 10-year G-sec yield declined from 6.6 percent in December’19 to 5.8 percent in July ’20. In such a scenario, there could be downward revision in PPF rates in the coming quarters. It is expected that RBI would resort to more Open Market Operations (OMOs) in the coming months, bringing down the yield that would enable the government to borrow at a cheaper rate.

Fixed Deposit (FD)

FD offered positive returns over the years, though by only a thin margin. For 5-year, 10-year, and 20-year period, inflation-adjusted returns were consistent at 1.8 percent. And, it fell below 1 percent for the 30-year period. In the present scenario, falling credit-growth in the economy is accompanied by the cut in bank deposit rates. As the income generated from the loans is on the decline, banks are trying to bring down the cost of servicing their liabilities, negatively impacting the savers.

Equity

Equity has emerged as the clear winner in terms of inflation-adjusted returns. Equity as an asset class (measured by BSE SENSEX) offered a double-digit inflation adjusted return of 15 percent for the 5-year period. For the 10-year, 20-year, and 30-year period, equity offered a decent inflation adjusted return of 7.4 percent, 8.5 percent, and 4 percent, respectively. Presently, after its low in March, equity markets are rallying high, mainly on account of the surplus liquidity in the system. From the low of 25981 on 23rd March ’20, SENSEX rose by around 50 percent to 38528 (on 18th August ’20).

Investment should be inflation-proof

Even though equity provides the best hedge against inflation, Indian households exposure towards equity market is limited. As per Reserve Bank of India’s Committee on Household Finance (2017), average Indian households hold 84 percent of its wealth in real estate and other physical goods, 11 percent in gold and the rest 5 percent in financial assets. Though investment in financial assets is gaining popularity, in India, physical assets are still considered to be the most preferred form of investment. And, within financial assets, currency and bank deposits accounts the bulk. As per the RBI bulletin, around 66 percent of the household assets are kept as bank deposits and cash. From the analysis, it was clear that the bank deposits offer only a thin margin in terms of inflation-adjusted returns.

Based on the risk appetite of the investor, one should maintain a portfolio of investment that maximises their returns. The thumb rule is that the returns from your investment should grow at a faster rate than the inflation rate.

Thank you madam.Your analysis is so good and very useful.